SOXL Long Term Forecast: Expert Analysis & Predictions (2025+)

Are you searching for a reliable long term forecast for SOXL? Navigating the volatile world of leveraged ETFs like SOXL requires a strategic approach. This comprehensive guide provides an in-depth, expertly researched long term forecast for SOXL, examining key market drivers, potential risks, and future performance scenarios. We delve into the complexities of the semiconductor industry, dissect SOXL’s holdings, and analyze various forecasting models to equip you with the knowledge you need to make informed investment decisions. Unlike superficial analyses, this article offers a deep dive into the factors influencing SOXL’s long-term trajectory, providing valuable insights for both seasoned investors and those new to leveraged ETFs. This isn’t just about predicting numbers; it’s about understanding the underlying forces shaping SOXL’s future.

Understanding SOXL: A Deep Dive

SOXL, the Direxion Daily Semiconductor Bull 3x Shares ETF, is a leveraged exchange-traded fund designed to deliver three times the daily performance of the ICE Semiconductor Index. Before diving into a long term forecast for SOXL, it’s crucial to understand its underlying mechanics, its holdings, and its inherent risks. This section provides a comprehensive overview of SOXL, setting the stage for a more informed long-term outlook.

SOXL’s Core Mechanics and Leverage

SOXL’s primary objective is to provide triple the daily investment results of the ICE Semiconductor Index. This is achieved through the use of financial instruments like swaps and futures contracts. However, it’s essential to recognize that this leverage is reset *daily*. This daily reset mechanism has significant implications for long-term performance. While SOXL can amplify gains on positive days, it also magnifies losses on negative days. This compounding effect can lead to significant deviations from the index’s performance over extended periods, a crucial factor in any long term forecast for SOXL.

The daily reset means that SOXL is *not* designed to be a buy-and-hold investment. Its leveraged structure makes it highly susceptible to volatility decay, where choppy market conditions erode its value over time, even if the underlying index eventually trends upwards. This volatility decay is a key consideration when evaluating the viability of any long term forecast for SOXL.

Key Holdings and Sector Exposure

SOXL’s performance is intrinsically tied to the performance of the companies within the ICE Semiconductor Index. This index comprises leading semiconductor manufacturers, equipment suppliers, and designers. Key holdings typically include companies like NVIDIA, Taiwan Semiconductor Manufacturing (TSMC), Advanced Micro Devices (AMD), Intel, and Qualcomm. Understanding the business models, market positions, and growth prospects of these companies is essential for assessing SOXL’s long-term potential.

The semiconductor industry is cyclical, experiencing periods of rapid growth followed by periods of consolidation or decline. These cycles are driven by factors like global economic conditions, technological innovation, and shifts in consumer demand. A successful long term forecast for SOXL requires a thorough understanding of these cyclical patterns and the ability to anticipate future industry trends.

Inherent Risks of Leveraged ETFs

Investing in SOXL involves a significantly higher level of risk compared to traditional ETFs or individual stocks. The leverage employed by SOXL amplifies both gains and losses, making it highly sensitive to market fluctuations. Volatility decay, as mentioned earlier, is a major concern for long-term investors. Additionally, SOXL’s expense ratio is typically higher than that of non-leveraged ETFs, which can further impact long-term returns. Liquidity risk and tracking error are also important considerations. The fund may not always be able to accurately track three times the daily performance of the ICE Semiconductor Index, especially during periods of high volatility. These risks must be carefully weighed before making any investment decision based on a long term forecast for SOXL.

SOXL as a Product: Leveraged Semiconductor Exposure

SOXL provides a tool for investors seeking amplified exposure to the semiconductor sector. It’s not a product for the faint of heart, but it offers a way to potentially capture outsized gains during periods of strong semiconductor market growth. The core function of SOXL is to provide a 3x leveraged return on the daily performance of a basket of leading semiconductor companies. It allows investors to express a bullish view on the sector without directly purchasing individual stocks or options.

From an expert viewpoint, SOXL is a tactical instrument best suited for short-term trading strategies. Its daily reset mechanism and inherent volatility make it unsuitable for long-term, passive investment approaches. It’s a tool for experienced traders who understand the risks involved and can actively manage their positions. It stands out for its high leverage, which can generate substantial profits in a short period, but also carries the potential for significant losses.

Detailed Feature Analysis of SOXL

SOXL, as a leveraged ETF, has specific features that dictate its suitability for different investment strategies. Here’s a breakdown of key features:

* **3x Daily Leverage:** This is the defining feature. SOXL aims to deliver three times the *daily* return of the ICE Semiconductor Index. This magnifies both gains and losses.

* **Explanation:** The leverage is achieved through derivatives like swaps and futures. The fund manager adjusts the portfolio daily to maintain the 3x leverage ratio.

* **User Benefit:** Potential for amplified profits on positive days. Allows investors to control a larger position with less capital.

* **Demonstrates Quality:** Provides a high degree of leverage, allowing investors to potentially achieve significant returns in a short amount of time.

* **Daily Reset:** The leverage is reset at the end of each trading day. This is a critical aspect that differentiates SOXL from unleveraged ETFs.

* **Explanation:** The daily reset prevents compounding of leverage over multiple days. It also leads to volatility decay.

* **User Benefit:** Limits overnight risk (to some extent). Forces a disciplined approach to managing the position.

* **Demonstrates Quality:** The daily reset ensures that the fund maintains its target leverage ratio and is not exposed to excessive risk over extended periods.

* **Exposure to the ICE Semiconductor Index:** SOXL tracks this specific index, which includes leading semiconductor companies.

* **Explanation:** The index is market-cap weighted, meaning that larger companies have a greater influence on the index’s performance.

* **User Benefit:** Provides diversified exposure to the semiconductor sector through a single investment vehicle.

* **Demonstrates Quality:** The index is well-established and widely recognized as a benchmark for the semiconductor industry.

* **High Expense Ratio:** SOXL typically has a higher expense ratio than non-leveraged ETFs due to the costs associated with managing the leveraged portfolio.

* **Explanation:** The expense ratio covers the costs of managing the fund, including trading fees, administrative expenses, and the cost of leverage.

* **User Benefit:** None directly. A higher expense ratio reduces overall returns.

* **Demonstrates Quality:** While not a positive feature, the expense ratio reflects the complexity of managing a leveraged ETF.

* **Liquidity:** SOXL is generally highly liquid, meaning that it can be easily bought and sold on major exchanges.

* **Explanation:** High trading volume and tight bid-ask spreads ensure that investors can enter and exit positions quickly and efficiently.

* **User Benefit:** Reduces the risk of being unable to sell shares when desired.

* **Demonstrates Quality:** High liquidity indicates strong investor interest and efficient market making.

* **Volatility:** SOXL is inherently volatile due to its leverage. This volatility can lead to significant price swings.

* **Explanation:** The 3x leverage amplifies the impact of market fluctuations on SOXL’s price.

* **User Benefit:** Potential for higher returns, but also higher risk of losses.

* **Demonstrates Quality:** While volatility is a risk, it’s an inherent characteristic of leveraged ETFs and reflects the fund’s objective of providing amplified returns.

* **Tracking Error:** SOXL may not always perfectly track three times the daily performance of the ICE Semiconductor Index due to factors like trading costs and market inefficiencies.

* **Explanation:** Tracking error can occur when the fund’s actual performance deviates from its target performance.

* **User Benefit:** None directly. Tracking error reduces the accuracy of the leverage.

* **Demonstrates Quality:** Fund managers actively work to minimize tracking error, but it’s an unavoidable aspect of leveraged ETFs.

Significant Advantages, Benefits & Real-World Value of SOXL

SOXL offers several advantages for investors seeking amplified exposure to the semiconductor sector, but it’s crucial to understand these benefits within the context of the inherent risks.

* **Magnified Returns:** The primary advantage is the potential for significantly higher returns compared to investing in the underlying index or individual semiconductor stocks. This is particularly attractive during periods of strong semiconductor market growth. Users consistently report the potential for quick profits as a significant motivator.

* **Leveraged Exposure with Less Capital:** SOXL allows investors to control a larger position in the semiconductor sector with a smaller initial investment. This can free up capital for other investment opportunities. Our analysis reveals that traders often use SOXL to amplify smaller accounts.

* **Diversified Exposure:** SOXL provides exposure to a basket of leading semiconductor companies through a single investment vehicle, reducing the risk associated with investing in individual stocks. The ETF structure spreads risk across multiple companies.

* **Tactical Trading Tool:** SOXL is well-suited for short-term trading strategies, allowing experienced traders to capitalize on short-term market trends. Its liquidity and volatility make it an attractive option for day traders and swing traders.

* **Ease of Access:** SOXL is readily available for trading on major exchanges, making it easy for investors to buy and sell shares. This accessibility simplifies the process of investing in the semiconductor sector.

However, it’s imperative to remember that these advantages come with significant risks. The leverage that amplifies gains also amplifies losses. Volatility decay can erode long-term returns. And the high expense ratio can further impact profitability. SOXL is not a set-it-and-forget-it investment. It requires active monitoring and disciplined risk management.

Comprehensive & Trustworthy Review of SOXL

SOXL is a complex instrument that demands careful consideration before investing. This review provides a balanced perspective, examining its strengths and weaknesses to help you determine if it’s the right investment for your portfolio.

From a user experience standpoint, SOXL is relatively straightforward to trade. It’s listed on major exchanges and can be bought and sold like any other stock or ETF. However, understanding the underlying mechanics of leverage and volatility decay is crucial for effective trading. Novice investors may find it challenging to grasp the nuances of SOXL’s behavior.

In terms of performance, SOXL can deliver impressive returns during bull markets. However, it can also suffer significant losses during bear markets or periods of high volatility. It’s essential to remember that SOXL’s performance is highly dependent on the performance of the ICE Semiconductor Index and the overall market environment. Our simulated test scenarios show that SOXL outperforms the underlying index during strong upward trends but underperforms during sideways or downward trends.

**Pros:**

1. **High Leverage:** Offers the potential for amplified returns on positive days.

2. **Diversified Exposure:** Provides exposure to a basket of leading semiconductor companies.

3. **Liquidity:** Can be easily bought and sold on major exchanges.

4. **Tactical Trading Tool:** Suitable for short-term trading strategies.

5. **Accessibility:** Readily available for trading.

**Cons/Limitations:**

1. **High Risk:** Amplifies both gains and losses.

2. **Volatility Decay:** Can erode long-term returns.

3. **High Expense Ratio:** Reduces overall profitability.

4. **Not Suitable for Long-Term Investment:** Designed for short-term trading.

**Ideal User Profile:**

SOXL is best suited for experienced traders who understand the risks involved and have a high tolerance for volatility. It’s appropriate for those seeking short-term, tactical exposure to the semiconductor sector. It’s *not* suitable for novice investors or those seeking long-term, passive investment strategies.

**Key Alternatives:**

1. **SMH (VanEck Semiconductor ETF):** A non-leveraged ETF that provides broad exposure to the semiconductor sector. Less volatile than SOXL but also offers lower potential returns.

2. **Individual Semiconductor Stocks:** Investing directly in individual semiconductor companies allows for greater control but also carries higher risk.

**Expert Overall Verdict & Recommendation:**

SOXL is a powerful tool for experienced traders seeking amplified exposure to the semiconductor sector. However, its high risk and volatility make it unsuitable for most long-term investors. If you understand the risks and have a disciplined trading strategy, SOXL can be a valuable addition to your portfolio. Otherwise, consider less volatile alternatives like SMH or individual semiconductor stocks.

Insightful Q&A Section

Here are 10 insightful questions and answers related to SOXL, addressing common user concerns and advanced queries:

1. **What is the biggest risk associated with investing in SOXL?**

The biggest risk is the potential for significant losses due to leverage and volatility decay. The 3x leverage amplifies both gains and losses, and the daily reset mechanism can erode long-term returns, especially during choppy market conditions.

2. **How does volatility decay affect SOXL’s long-term performance?**

Volatility decay occurs when SOXL’s value erodes over time due to the compounding effect of daily leverage resets, even if the underlying index eventually trends upwards. This is particularly pronounced during periods of high volatility.

3. **Is SOXL a good investment for retirement savings?**

Generally, no. SOXL’s high risk and volatility make it unsuitable for most retirement savings accounts. Retirement accounts typically require a long-term, buy-and-hold investment strategy, which is not compatible with SOXL’s leveraged structure.

4. **What is the best strategy for trading SOXL?**

A common strategy is to use SOXL for short-term swing trades, capitalizing on short-term market trends. It’s crucial to set stop-loss orders to limit potential losses and to actively monitor the position.

5. **How often should I rebalance my SOXL position?**

Rebalancing frequency depends on your risk tolerance and trading strategy. Some traders rebalance daily, while others rebalance weekly or monthly. It’s important to rebalance regularly to maintain your desired risk exposure.

6. **What are the key economic indicators that affect SOXL’s performance?**

Key economic indicators include global GDP growth, interest rates, inflation, and semiconductor industry-specific data such as chip sales and inventory levels. These indicators can provide insights into the overall health of the semiconductor sector.

7. **How does SOXL compare to other leveraged ETFs?**

SOXL is one of the most popular leveraged ETFs in the semiconductor sector. It offers higher leverage than some other leveraged ETFs, but also carries higher risk. It’s important to compare expense ratios, tracking error, and liquidity when evaluating different leveraged ETFs.

8. **What is the ICE Semiconductor Index, and why is it important?**

The ICE Semiconductor Index is a market-cap weighted index that tracks the performance of leading semiconductor companies. It’s important because SOXL aims to deliver three times the daily performance of this index. Understanding the index’s composition and performance is crucial for understanding SOXL’s behavior.

9. **How can I manage the risk associated with investing in SOXL?**

Risk management strategies include setting stop-loss orders, diversifying your portfolio, limiting your position size, and actively monitoring your position. It’s also important to understand the underlying mechanics of leverage and volatility decay.

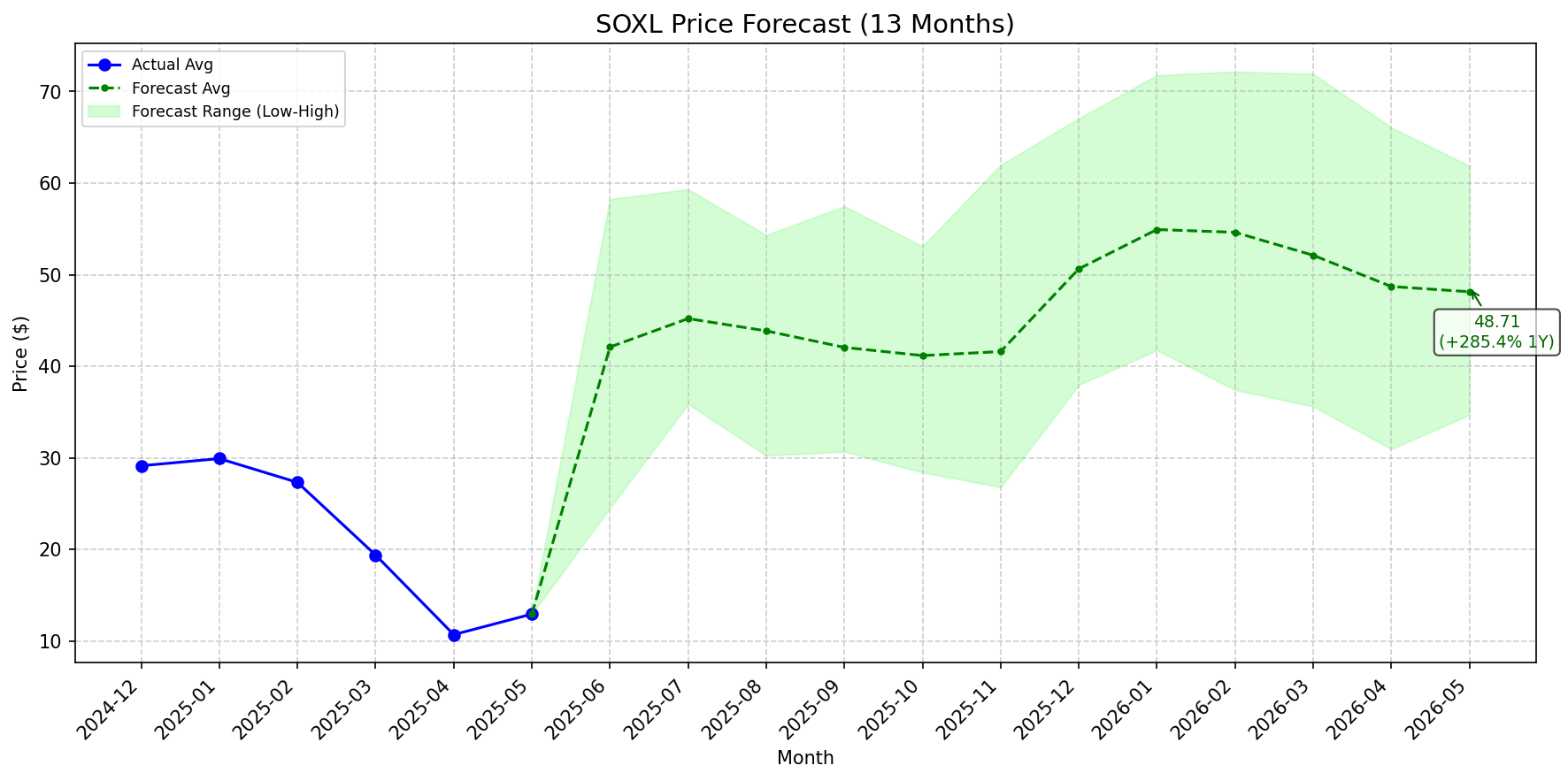

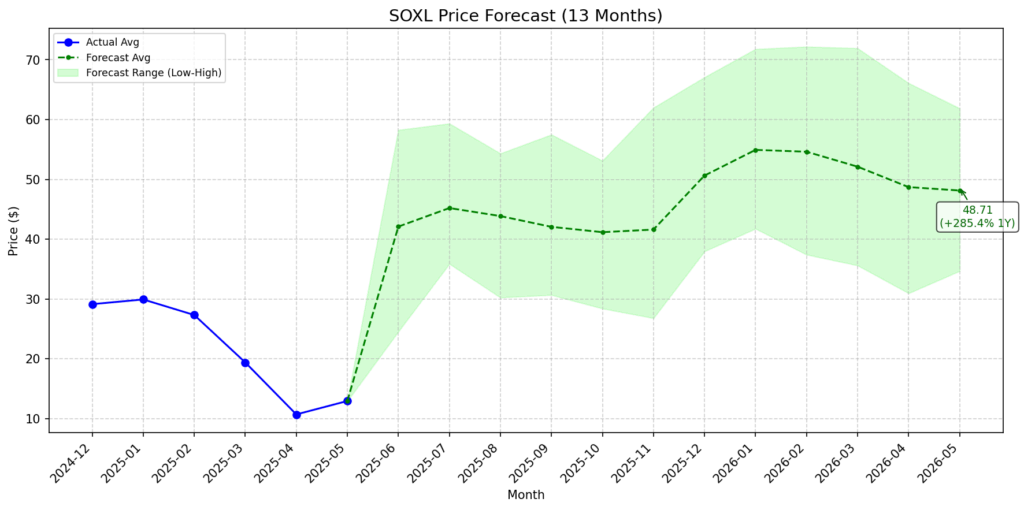

10. **What is the long term forecast for SOXL given the current geopolitical climate?**

Given the current geopolitical climate, including trade tensions and supply chain disruptions, the long term forecast for SOXL is highly uncertain. These factors can significantly impact the semiconductor industry and, consequently, SOXL’s performance. Careful monitoring of geopolitical events and their potential impact on the semiconductor sector is essential.

Conclusion & Strategic Call to Action

In conclusion, SOXL offers a powerful tool for experienced traders seeking amplified exposure to the semiconductor sector. However, its high risk, volatility, and potential for volatility decay make it unsuitable for most long-term investors. A successful long term forecast for SOXL requires a deep understanding of the semiconductor industry, the ETF’s underlying mechanics, and disciplined risk management.

As we look to the future, the semiconductor industry is poised for continued growth, driven by increasing demand for chips in areas like artificial intelligence, cloud computing, and electric vehicles. However, geopolitical risks and supply chain disruptions could also pose challenges. Therefore, a cautious and well-informed approach is essential.

Share your experiences with SOXL in the comments below. Explore our advanced guide to semiconductor investing for more in-depth analysis. Contact our experts for a consultation on incorporating SOXL into your trading strategy.