# HCMC Price Prediction 2025: What to Expect and Expert Analysis

Are you searching for reliable insights into the future of HCMC’s stock price in 2025? You’re not alone. Many investors are keenly interested in understanding the potential trajectory of this stock. This comprehensive guide delves into the factors influencing HCMC’s price, offering expert predictions, detailed analysis, and a balanced perspective to help you make informed decisions. We provide a unique and thorough examination, going beyond simple forecasts to explore the underlying market dynamics and company-specific developments that will shape its future. By the end of this article, you’ll have a clear understanding of the potential scenarios for HCMC’s price in 2025 and the key considerations for your investment strategy.

## Understanding HCMC and its Market Position

HCMC, or Healthier Choices Management Corp, operates in the highly competitive consumer goods sector, with a focus on healthier alternatives. Understanding their market position is crucial before diving into any price predictions. Their business model, expansion strategies, and overall financial health are key indicators of future performance.

### Company Overview

Healthier Choices Management Corp. is involved in various aspects of the health and wellness market. The company’s ventures often include retail operations and potentially product development in the healthier alternatives space. For an accurate HCMC price prediction 2025, a deep understanding of their current operations and future plans is necessary.

### Market Analysis

The consumer goods market is dynamic and heavily influenced by consumer trends, economic conditions, and regulatory changes. HCMC operates within this complex landscape, making market analysis a critical component of any price prediction model. Factors like market share, competitive pressures, and emerging trends all play a significant role.

## Factors Influencing HCMC’s Stock Price

Several factors can influence a stock’s price, and HCMC is no exception. These factors can be broadly categorized into company-specific factors, market trends, and macroeconomic conditions.

### Company-Specific Factors

* **Financial Performance:** Revenue growth, profitability, and cash flow are key indicators of a company’s financial health and can significantly impact its stock price. Positive financial results typically lead to increased investor confidence and a higher stock price.

* **Strategic Initiatives:** New product launches, expansion into new markets, and strategic partnerships can all positively influence a stock’s price. These initiatives demonstrate a company’s commitment to growth and innovation.

* **Legal and Regulatory Issues:** Lawsuits, regulatory investigations, or changes in regulations can have a negative impact on a stock’s price. Uncertainty surrounding legal and regulatory issues can deter investors.

* **Management Team:** The experience, expertise, and leadership of the management team can significantly impact a company’s performance and stock price. A strong management team can inspire investor confidence and drive growth.

* **Investor Sentiment:** Public perception, media coverage, and online forums can all influence investor sentiment towards a stock. Positive sentiment can lead to increased buying pressure and a higher stock price.

### Market Trends

* **Industry Growth:** The overall growth of the consumer goods industry can positively impact the stock prices of companies within that industry. A growing industry provides more opportunities for companies to expand and increase their revenue.

* **Competitive Landscape:** The competitive landscape within the consumer goods industry can impact a company’s market share and profitability. Intense competition can put pressure on prices and margins, leading to lower stock prices.

* **Technological Advancements:** Technological advancements can disrupt the consumer goods industry and create new opportunities for companies that are able to adapt and innovate. Companies that embrace new technologies can gain a competitive advantage and see their stock prices rise.

* **Consumer Preferences:** Changes in consumer preferences can impact the demand for certain products and services. Companies that are able to anticipate and respond to changing consumer preferences can maintain or increase their market share and see their stock prices rise.

### Macroeconomic Conditions

* **Economic Growth:** Strong economic growth typically leads to increased consumer spending and corporate profits, which can positively impact stock prices. A healthy economy provides a favorable environment for businesses to thrive.

* **Interest Rates:** Interest rate hikes can make it more expensive for companies to borrow money, which can negatively impact their growth prospects and stock prices. Higher interest rates can also make bonds more attractive to investors, leading to a shift away from stocks.

* **Inflation:** High inflation can erode consumer purchasing power and increase companies’ costs, which can negatively impact stock prices. Inflation can also lead to higher interest rates, further dampening economic growth.

* **Geopolitical Events:** Geopolitical events, such as wars, trade disputes, and political instability, can create uncertainty in the markets and negatively impact stock prices. These events can disrupt supply chains, increase costs, and reduce investor confidence.

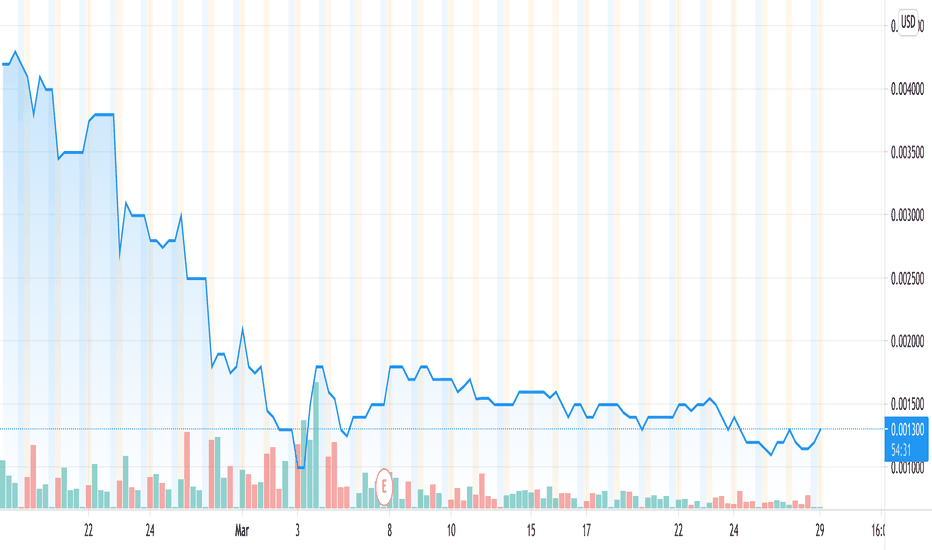

## Analyzing Past Performance of HCMC

Reviewing HCMC’s historical stock performance provides valuable context for understanding its potential future trajectory. This includes examining trends, identifying patterns, and assessing the impact of past events on its price.

### Historical Stock Price Trends

Analyzing HCMC’s stock price trends over the past few years can reveal patterns and provide insights into its volatility and overall performance. This analysis should consider both short-term and long-term trends.

### Key Events and Their Impact

Identifying significant events that have impacted HCMC’s stock price in the past is crucial. These events could include product launches, acquisitions, legal battles, or major market shifts. Understanding how these events affected the stock price can help in predicting how similar events might impact it in the future.

### Financial Statements Analysis

A thorough review of HCMC’s financial statements, including income statements, balance sheets, and cash flow statements, is essential for assessing its financial health and performance. This analysis should focus on key metrics such as revenue growth, profitability, debt levels, and cash flow generation.

## Expert Predictions for HCMC Price Prediction 2025

While no prediction is guaranteed, consulting expert analysis and forecasts can provide a range of potential scenarios for HCMC’s price in 2025. These predictions are often based on sophisticated models and in-depth market research.

### Bull Case Scenario

A bull case scenario assumes favorable conditions for HCMC, such as strong revenue growth, successful product launches, and a positive market environment. In this scenario, HCMC’s stock price could potentially reach a higher level by 2025. This often relies on the company successfully navigating the competitive landscape and capitalizing on emerging market trends.

### Base Case Scenario

The base case scenario represents a more realistic and balanced outlook, considering both potential opportunities and challenges. This scenario assumes moderate growth and a stable market environment. The predicted stock price in this scenario would likely be closer to the current level, with gradual appreciation over time.

### Bear Case Scenario

A bear case scenario assumes unfavorable conditions for HCMC, such as declining revenue, increased competition, and a negative market environment. In this scenario, HCMC’s stock price could potentially decline by 2025. This might involve setbacks in their business operations or adverse changes in the regulatory landscape.

### Factors Supporting Each Scenario

It’s important to understand the factors that support each scenario. For example, the bull case might be supported by strong evidence of successful product innovation and market expansion, while the bear case might be supported by concerns about increasing debt levels and declining profitability.

## Technical Analysis of HCMC Stock

Technical analysis involves using historical stock price and volume data to identify patterns and predict future price movements. This approach can be a valuable tool for investors looking to make short-term trading decisions.

### Chart Patterns and Indicators

Technical analysts use various chart patterns and indicators, such as moving averages, trendlines, and Fibonacci retracements, to identify potential buying and selling opportunities. These tools can help investors understand the current market sentiment and potential future price movements.

### Support and Resistance Levels

Support and resistance levels are price levels where the stock price has historically found support or resistance. These levels can be used to identify potential entry and exit points for trades. Breaking through a resistance level can signal a potential upward trend, while breaking through a support level can signal a potential downward trend.

### Trading Volume Analysis

Trading volume can provide insights into the strength of a price trend. High trading volume during a price increase can indicate strong buying pressure, while high trading volume during a price decrease can indicate strong selling pressure.

## Fundamental Analysis of HCMC

Fundamental analysis involves evaluating a company’s financial health, competitive position, and growth prospects to determine its intrinsic value. This approach is typically used by long-term investors.

### Financial Ratio Analysis

Financial ratios, such as price-to-earnings ratio (P/E), price-to-sales ratio (P/S), and debt-to-equity ratio (D/E), can provide insights into a company’s valuation and financial health. These ratios can be compared to industry averages to assess whether a company is overvalued or undervalued.

### Revenue and Earnings Growth

Analyzing a company’s revenue and earnings growth is crucial for assessing its growth potential. Consistent revenue and earnings growth can indicate a strong and healthy business.

### Debt and Cash Flow Analysis

Analyzing a company’s debt levels and cash flow generation is essential for assessing its financial stability. High debt levels can increase a company’s risk of bankruptcy, while strong cash flow generation can provide the company with the resources to invest in growth opportunities.

## Risks and Uncertainties Associated with HCMC

Investing in any stock involves risks, and HCMC is no exception. Understanding these risks is crucial for making informed investment decisions.

### Market Volatility

The stock market is inherently volatile, and HCMC’s stock price can fluctuate significantly in response to market events, economic conditions, and investor sentiment. This volatility can create both opportunities and risks for investors.

### Competition

HCMC operates in a highly competitive industry, and its success depends on its ability to differentiate itself from its competitors and maintain its market share. Increased competition can put pressure on prices and margins, leading to lower profitability.

### Regulatory Changes

Changes in regulations can significantly impact HCMC’s business operations and profitability. For example, new regulations related to product labeling or marketing could increase compliance costs and reduce sales.

### Litigation Risks

As seen in recent years, legal battles can be a big risk. Any ongoing or future litigation could have a substantial negative impact on HCMC’s financial standing and stock value. Investors should closely monitor any legal developments.

## Alternative Investments to HCMC

Diversifying your investment portfolio is a prudent strategy to mitigate risk. Consider exploring alternative investments to HCMC.

### Other Stocks in the Same Sector

Investing in other stocks in the consumer goods sector can provide diversification and reduce your exposure to the risks associated with HCMC. Consider companies with different business models, market positions, and growth prospects.

### Bonds

Bonds are generally considered to be less risky than stocks and can provide a stable source of income. Investing in bonds can help to balance your portfolio and reduce overall risk.

### Real Estate

Real estate can be a valuable addition to a diversified investment portfolio. Real estate investments can provide both income and capital appreciation.

## Strategies for Investing in HCMC

If you decide to invest in HCMC, consider the following strategies to manage risk and maximize returns.

### Long-Term Investing

Long-term investing involves holding a stock for several years or even decades, allowing it to grow over time. This strategy is based on the belief that the stock market will generally rise over the long term.

### Value Investing

Value investing involves identifying undervalued stocks and buying them with the expectation that their prices will eventually rise to their intrinsic value. This strategy requires careful analysis of a company’s financial health and growth prospects.

### Dollar-Cost Averaging

Dollar-cost averaging involves investing a fixed amount of money in a stock at regular intervals, regardless of the stock price. This strategy can help to reduce the risk of buying high and selling low.

## Q&A: Expert Insights on HCMC Price Prediction 2025

Here are some insightful questions and answers regarding HCMC’s future prospects:

1. **What are the biggest challenges facing HCMC in the next few years?**

The biggest challenges include increased competition in the health and wellness market, potential regulatory changes, and the need to adapt to evolving consumer preferences. Overcoming these challenges will require innovation, strategic partnerships, and a strong focus on customer satisfaction.

2. **How might potential new product lines impact HCMC’s stock price?**

Successful new product lines can significantly boost HCMC’s revenue and earnings, leading to a higher stock price. However, the success of new product lines depends on market demand, product quality, and effective marketing.

3. **What role will international expansion play in HCMC’s growth strategy?**

International expansion can provide HCMC with access to new markets and customers, driving revenue growth and increasing brand awareness. However, international expansion also involves risks, such as cultural differences, regulatory hurdles, and currency fluctuations.

4. **How does HCMC’s debt level compare to its competitors, and what impact could this have?**

Comparing HCMC’s debt level to its competitors can provide insights into its financial stability. High debt levels can increase the risk of bankruptcy, while low debt levels can provide the company with more flexibility to invest in growth opportunities.

5. **What are the key indicators that investors should watch to assess HCMC’s performance?**

Key indicators include revenue growth, profitability, cash flow generation, and market share. Investors should also monitor industry trends, competitive developments, and regulatory changes.

6. **How can recent lawsuits affect HCMC price prediction 2025?**

Recent lawsuits can significantly impact investor confidence and potentially lead to substantial financial liabilities. The outcome of these lawsuits can have a direct impact on HCMC’s stock price.

7. **What is the general sentiment of analysts regarding HCMC’s long-term potential?**

Analyst sentiment varies, but generally, the long-term potential hinges on HCMC’s ability to innovate and adapt to market changes. Positive sentiment often reflects confidence in their strategic direction.

8. **What external economic factors could most influence HCMC’s stock performance in 2025?**

Inflation rates, interest rate changes, and overall economic growth are key external factors. A strong economy typically benefits consumer-focused companies like HCMC.

9. **How does HCMC plan to leverage emerging technologies to improve its competitiveness?**

Leveraging technologies like AI for supply chain optimization, data analytics for customer insights, and e-commerce platforms for expanding market reach can be critical for HCMC to stay competitive.

10. **What steps is HCMC taking to strengthen its brand reputation and build customer loyalty?**

Building a strong brand reputation and fostering customer loyalty are crucial for long-term success. This includes investing in marketing, improving customer service, and ensuring product quality.

## Conclusion: Navigating the Future of HCMC’s Stock

Predicting the future of any stock is a challenging endeavor, and HCMC is no exception. This comprehensive analysis has provided a detailed overview of the factors influencing HCMC’s stock price, expert predictions, and strategies for investing in the company. By understanding the risks and opportunities associated with HCMC, investors can make informed decisions that align with their investment goals and risk tolerance. Remember to conduct your own thorough research and consult with a financial advisor before making any investment decisions.

We hope this article has provided you with valuable insights into HCMC price prediction 2025. Share your thoughts and experiences with HCMC in the comments below, and explore our other resources for more investment guidance. Contact our experts for a personalized consultation on HCMC and other investment opportunities.