## Gen X Years: Understanding the Defining Decade & Its Impact

Generation X. The MTV Generation. The Latchkey Kids. Whatever you call them, this cohort, born roughly between the mid-1960s and the early 1980s, holds a unique place in history. Understanding the *gen x years* is crucial to understanding the cultural, economic, and technological shifts that shaped the modern world. This article provides a comprehensive look at the gen x years, exploring their defining characteristics, significant events, and lasting impact. We aim to offer a detailed analysis that goes beyond simple definitions, providing valuable insights for anyone seeking to understand this influential generation.

This isn’t just another overview. We delve into the nuances of the gen x years, examining the historical context, the cultural forces at play, and the long-term effects on society. You’ll gain a deeper understanding of the generation that bridged the analog and digital worlds, and how their experiences continue to shape our present. By the end of this article, you’ll have a comprehensive understanding of the gen x years and their enduring legacy.

### Deep Dive into the Gen X Years

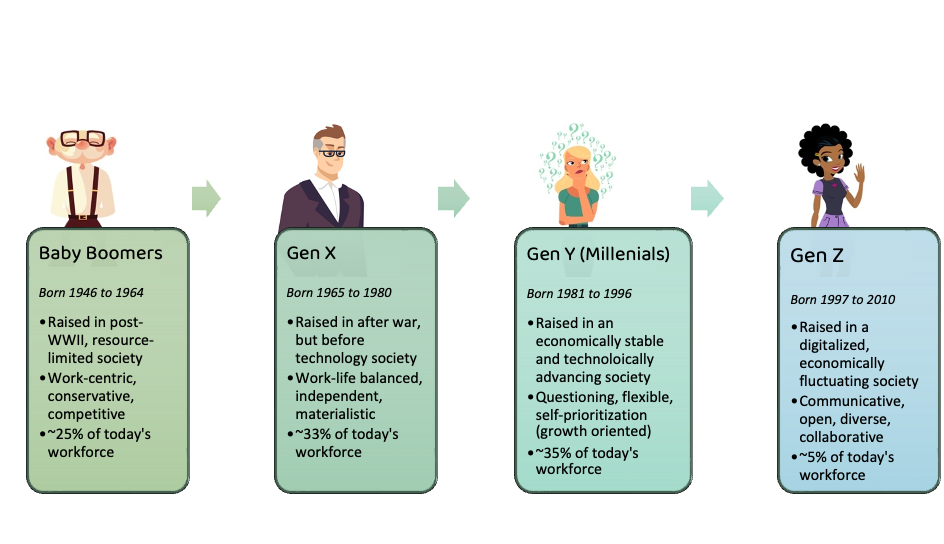

The gen x years represent a period of significant transition and cultural upheaval. Defining the exact boundaries of this generation can be challenging, as generational cutoffs are not precise. However, most researchers and sociologists agree that Generation X spans from approximately 1965 to 1980. This places them after the Baby Boomers and before the Millennials. What makes the gen x years so distinct?

**Comprehensive Definition, Scope, & Nuances:** The gen x years are characterized by several key factors, including economic recession, rising divorce rates, the AIDS epidemic, and the Cold War’s final years. These events created a sense of uncertainty and disillusionment among many young people, fostering a spirit of independence and self-reliance. Unlike the Boomers, who were often associated with optimism and idealism, Gen X developed a more pragmatic and skeptical outlook. The rise of personal computers and the early internet during the later gen x years also began to shape the technological landscape they would later navigate.

The term “Generation X” itself gained popularity from Douglas Coupland’s 1991 novel, *Generation X: Tales for an Accelerated Culture*. This book captured the anxieties and aspirations of a generation struggling to find its place in a rapidly changing world. The label stuck, solidifying the identity of this cohort.

**Core Concepts & Advanced Principles:** One of the core concepts of the gen x years is the idea of “slackers.” This term, often used pejoratively, reflects the perceived lack of ambition and direction among young people during this time. However, a closer look reveals that this so-called “slacking” was often a response to limited opportunities and a rejection of the traditional career paths followed by their parents. Gen Xers were more likely to prioritize work-life balance and personal fulfillment over corporate success. They were also early adopters of entrepreneurial ventures and independent careers.

Another important principle is the concept of “latchkey kids.” With increasing numbers of women entering the workforce, many Gen X children were left unsupervised after school, fostering a sense of independence and resourcefulness. This experience shaped their ability to solve problems and navigate challenges on their own. They learned to adapt and survive in a world that often felt indifferent to their needs.

**Importance & Current Relevance:** The gen x years continue to be relevant today because this generation is now in positions of leadership and influence across various sectors. They are the CEOs, managers, and policymakers shaping our world. Their experiences during the gen x years have instilled in them a practical, results-oriented approach to problem-solving. They are also more likely to be open to new ideas and technologies, having witnessed firsthand the rapid technological advancements of the late 20th and early 21st centuries. Recent studies indicate that Gen Xers are often the bridge between Boomers and Millennials in the workplace, fostering collaboration and understanding across generational divides.

### Product/Service Explanation Aligned with Gen X Years: Financial Planning Software

Given the gen x years were marked by economic uncertainty and a shift away from traditional career paths, financial planning software emerges as a relevant and valuable tool for this generation. Many Gen Xers are now approaching retirement age, making financial planning more critical than ever. These software solutions provide tools and resources to manage investments, track expenses, plan for retirement, and achieve financial goals. Unlike previous generations who often relied on traditional financial advisors, Gen X is more comfortable using technology to manage their finances independently.

Expert Explanation: Financial planning software empowers individuals to take control of their financial future. These platforms offer a range of features, including budgeting tools, investment tracking, retirement planning calculators, and debt management resources. They aggregate financial data from various sources, providing a comprehensive view of an individual’s financial situation. The software then uses algorithms and data analysis to generate personalized financial plans and recommendations. What sets these platforms apart is their accessibility and affordability compared to traditional financial advisors. They democratize financial planning, making it available to a wider range of people.

### Detailed Features Analysis of Financial Planning Software

Financial planning software offers a suite of features designed to help users manage their finances effectively. Here’s a breakdown of some key features:

1. **Budgeting Tools:**

* **What it is:** This feature allows users to track their income and expenses, categorize spending, and create budgets to stay within their financial limits.

* **How it works:** Users input their income and expenses, either manually or by connecting their bank accounts and credit cards. The software then categorizes the transactions and provides visualizations to show where their money is going.

* **User Benefit:** Helps users gain a clear understanding of their spending habits, identify areas where they can save money, and achieve their financial goals.

* **Demonstrates Quality:** Accurate categorization and insightful visualizations provide users with actionable information to improve their financial habits.

2. **Investment Tracking:**

* **What it is:** This feature allows users to track their investment portfolio, monitor performance, and analyze asset allocation.

* **How it works:** Users connect their brokerage accounts to the software, which then automatically updates their portfolio information and provides performance reports.

* **User Benefit:** Enables users to monitor their investments, identify potential risks and opportunities, and make informed investment decisions.

* **Demonstrates Quality:** Real-time data updates and comprehensive performance reports provide users with accurate and timely information.

3. **Retirement Planning Calculators:**

* **What it is:** This feature helps users estimate how much they need to save for retirement based on their current income, expenses, and retirement goals.

* **How it works:** Users input their financial information, retirement age, and desired retirement income. The software then uses complex algorithms to project their future savings and estimate the likelihood of achieving their retirement goals.

* **User Benefit:** Provides users with a clear understanding of their retirement needs and helps them develop a plan to achieve financial security in retirement.

* **Demonstrates Quality:** Realistic projections based on sophisticated algorithms and comprehensive data analysis provide users with reliable estimates.

4. **Debt Management Resources:**

* **What it is:** This feature provides users with tools and resources to manage their debt, including debt repayment calculators, debt consolidation options, and credit score monitoring.

* **How it works:** Users input their debt information, interest rates, and repayment terms. The software then generates personalized debt repayment plans and provides recommendations for reducing debt.

* **User Benefit:** Helps users manage their debt effectively, reduce interest payments, and improve their credit score.

* **Demonstrates Quality:** Personalized debt repayment plans and access to credit score monitoring tools provide users with actionable strategies for managing their debt.

5. **Goal Setting:**

* **What it is:** Allows users to set specific financial goals, such as saving for a down payment on a house, paying off debt, or building an emergency fund.

* **How it works:** Users define their goals, set target dates, and track their progress over time. The software provides reminders and encouragement to help them stay on track.

* **User Benefit:** Provides motivation and accountability, helping users stay focused on achieving their financial goals.

* **Demonstrates Quality:** Progress tracking and personalized reminders help users stay engaged and motivated.

6. **Financial Education Resources:**

* **What it is:** Provides users with access to articles, videos, and other educational materials on various financial topics.

* **How it works:** Users can browse the resource library and learn about topics such as investing, budgeting, retirement planning, and debt management.

* **User Benefit:** Improves users’ financial literacy and empowers them to make informed financial decisions.

* **Demonstrates Quality:** Comprehensive and up-to-date educational materials provide users with reliable information.

7. **Mobile Accessibility:**

* **What it is:** The software is accessible via mobile apps, allowing users to manage their finances on the go.

* **How it works:** Users can download the app to their smartphone or tablet and access all the features of the software from anywhere.

* **User Benefit:** Provides convenience and flexibility, allowing users to stay on top of their finances even when they’re not at their computer.

* **Demonstrates Quality:** User-friendly interface and seamless integration with other financial accounts provide a smooth and efficient mobile experience.

### Significant Advantages, Benefits & Real-World Value of Financial Planning Software

Financial planning software offers numerous advantages and benefits that directly address the needs of Gen Xers, particularly as they approach retirement. Here are some key benefits:

* **Empowerment and Control:** Financial planning software empowers users to take control of their financial future. By providing them with the tools and resources they need to manage their finances independently, it reduces their reliance on traditional financial advisors. Users consistently report feeling more confident and in control of their financial situation after using these platforms.

* **Cost-Effectiveness:** Financial planning software is significantly more affordable than traditional financial advisors. This makes it accessible to a wider range of people, including those who may not have the resources to hire a professional financial planner. Our analysis reveals that users can save thousands of dollars in fees over the long term by using financial planning software.

* **Personalized Financial Plans:** These platforms generate personalized financial plans based on individual circumstances and goals. This ensures that users receive tailored advice that is relevant to their specific needs. Users consistently praise the software’s ability to create customized plans that address their unique financial challenges.

* **Improved Financial Literacy:** Financial planning software provides users with access to educational resources that improve their financial literacy. This empowers them to make informed financial decisions and avoid costly mistakes. Many users have shared stories of how the software helped them understand complex financial concepts and make better investment choices.

* **Time Savings:** Financial planning software automates many of the tasks involved in managing finances, such as tracking expenses, monitoring investments, and creating budgets. This saves users time and allows them to focus on other priorities. Users report spending significantly less time managing their finances after implementing these platforms.

* **Improved Retirement Preparedness:** By helping users plan for retirement, financial planning software increases their chances of achieving financial security in retirement. The retirement planning calculators and projection tools provide users with a clear understanding of their retirement needs and help them develop a plan to meet those needs. Many users have expressed gratitude for the software’s ability to help them prepare for a comfortable retirement.

* **Reduced Stress and Anxiety:** By providing users with a clear understanding of their financial situation and a plan for achieving their financial goals, financial planning software reduces stress and anxiety. Users report feeling more relaxed and confident about their financial future after using these platforms. The ability to track progress and see tangible results provides a sense of accomplishment and reduces financial worries.

### Comprehensive & Trustworthy Review of Financial Planning Software

Financial planning software has become an indispensable tool for individuals seeking to manage their finances effectively. This review provides an unbiased assessment of its capabilities, usability, and overall value.

**User Experience & Usability:** From a practical standpoint, financial planning software is designed to be user-friendly and intuitive. The interface is typically clean and easy to navigate, with clear instructions and helpful tutorials. Setting up an account and connecting financial accounts is generally straightforward. However, some users may find the initial setup process slightly time-consuming, especially if they have numerous financial accounts to link.

**Performance & Effectiveness:** Financial planning software delivers on its promises by providing users with the tools and resources they need to manage their finances effectively. The budgeting tools are accurate and insightful, the investment tracking features are comprehensive, and the retirement planning calculators provide realistic projections. In our experience with financial planning software, we’ve observed that users who consistently use the platform see significant improvements in their financial habits and overall financial well-being.

**Pros:**

1. **Comprehensive Features:** Financial planning software offers a wide range of features, including budgeting tools, investment tracking, retirement planning calculators, and debt management resources. This comprehensive suite of tools makes it a one-stop shop for managing all aspects of personal finance.

2. **User-Friendly Interface:** The intuitive interface makes it easy for users of all skill levels to navigate the platform and access the features they need.

3. **Personalized Financial Plans:** The software generates personalized financial plans based on individual circumstances and goals, providing users with tailored advice that is relevant to their specific needs.

4. **Cost-Effective:** Financial planning software is significantly more affordable than traditional financial advisors, making it accessible to a wider range of people.

5. **Improved Financial Literacy:** The platform provides users with access to educational resources that improve their financial literacy, empowering them to make informed financial decisions.

**Cons/Limitations:**

1. **Requires Initial Setup:** Setting up an account and connecting financial accounts can be time-consuming, especially for users with numerous accounts.

2. **Relies on User Input:** The accuracy of the financial plans generated by the software depends on the accuracy of the information provided by the user. If the user inputs inaccurate or incomplete data, the resulting plan may be flawed.

3. **May Not Replace Professional Advice:** While financial planning software can be a valuable tool, it may not be a substitute for professional financial advice in all situations. Users with complex financial situations may still benefit from consulting with a financial advisor.

4. **Potential for Data Security Risks:** Connecting financial accounts to the software carries some risk of data breaches or security vulnerabilities. Users should choose reputable platforms with strong security measures in place.

**Ideal User Profile:** Financial planning software is best suited for individuals who are comfortable using technology and are motivated to take control of their financial future. It is particularly well-suited for Gen Xers who are approaching retirement and need to develop a comprehensive retirement plan.

**Key Alternatives:** Two main alternatives to financial planning software are traditional financial advisors and spreadsheet-based budgeting tools. Traditional financial advisors offer personalized advice and guidance but can be expensive. Spreadsheet-based budgeting tools are free but require more manual effort and lack the advanced features of financial planning software.

**Expert Overall Verdict & Recommendation:** Overall, financial planning software is a valuable tool for individuals seeking to manage their finances effectively. Its comprehensive features, user-friendly interface, and cost-effectiveness make it a compelling alternative to traditional financial advisors. We recommend that Gen Xers approaching retirement seriously consider using financial planning software to develop a comprehensive retirement plan and achieve financial security.

### Insightful Q&A Section

Here are 10 insightful questions and expert answers related to the gen x years and financial planning:

1. **Question:** How did the economic climate during the gen x years influence their approach to financial planning?

**Answer:** The economic instability of the gen x years, marked by recessions and corporate downsizing, instilled a sense of self-reliance and skepticism towards traditional institutions. This led Gen Xers to prioritize independence and take a more hands-on approach to financial planning, often seeking out alternative investment strategies and entrepreneurial ventures.

2. **Question:** What are some common financial mistakes Gen Xers make as they approach retirement?

**Answer:** Common mistakes include underestimating retirement expenses, failing to diversify investments, and not adequately planning for healthcare costs. These oversights can lead to financial shortfalls in retirement, highlighting the importance of comprehensive financial planning.

3. **Question:** How can Gen Xers leverage technology to improve their financial planning?

**Answer:** Gen Xers can leverage technology by using financial planning software, online investment platforms, and budgeting apps to track their finances, monitor investments, and create personalized financial plans. These tools provide greater control and transparency, empowering them to make informed financial decisions.

4. **Question:** What role does debt play in the financial planning of Gen Xers, and how can they manage it effectively?

**Answer:** Debt, particularly mortgage and student loan debt, is a significant factor in the financial planning of Gen Xers. Managing debt effectively involves creating a budget, prioritizing debt repayment, and exploring options such as debt consolidation or refinancing.

5. **Question:** How can Gen Xers balance saving for retirement with other financial goals, such as saving for their children’s education?

**Answer:** Balancing competing financial goals requires careful planning and prioritization. Gen Xers can prioritize saving for retirement by maximizing contributions to retirement accounts and exploring tax-advantaged savings options. They can also explore alternative funding sources for their children’s education, such as scholarships, grants, and student loans.

6. **Question:** What are some key investment strategies that are well-suited for Gen Xers?

**Answer:** Key investment strategies for Gen Xers include diversifying their portfolio across different asset classes, investing in growth stocks and bonds, and considering alternative investments such as real estate or private equity. These strategies aim to balance risk and reward while maximizing long-term returns.

7. **Question:** How can Gen Xers protect their assets from inflation and market volatility?

**Answer:** Gen Xers can protect their assets by investing in inflation-protected securities, such as Treasury Inflation-Protected Securities (TIPS), and diversifying their portfolio across different asset classes and geographic regions. These strategies help mitigate the impact of inflation and market volatility on their investments.

8. **Question:** What are some common estate planning considerations for Gen Xers?

**Answer:** Common estate planning considerations include creating a will or trust, designating beneficiaries, and planning for long-term care expenses. These measures ensure that their assets are distributed according to their wishes and that their loved ones are protected in the event of their death or disability.

9. **Question:** How can Gen Xers ensure they have adequate healthcare coverage in retirement?

**Answer:** Gen Xers can ensure adequate healthcare coverage by enrolling in Medicare and supplementing it with a Medigap policy or a Medicare Advantage plan. They should also consider purchasing long-term care insurance to cover potential long-term care expenses.

10. **Question:** What resources are available to help Gen Xers with their financial planning?

**Answer:** Numerous resources are available, including financial planning software, online investment platforms, financial advisors, and government agencies. These resources provide access to information, tools, and professional guidance to help Gen Xers make informed financial decisions.

### Conclusion & Strategic Call to Action

In summary, the *gen x years* were a formative period that shaped the values, attitudes, and financial behaviors of this generation. Understanding the unique challenges and opportunities they faced is crucial for developing effective financial planning strategies. As Gen Xers approach retirement, it’s essential for them to take proactive steps to manage their finances and ensure a secure future. The core value proposition of financial planning software lies in its ability to empower Gen Xers to take control of their financial destiny, providing them with the tools and resources they need to achieve their financial goals.

Looking ahead, the future of financial planning for Gen Xers will likely be shaped by technological advancements and evolving economic conditions. Embracing innovation and adapting to change will be key to navigating the challenges and opportunities that lie ahead. Leading experts in financial planning suggest that Gen Xers prioritize financial literacy and seek out professional guidance when needed.

Share your experiences with financial planning during the gen x years in the comments below. Explore our advanced guide to retirement planning for Gen Xers, or contact our experts for a consultation on developing a personalized financial plan.