## Understanding FY25: A Complete Calendar Breakdown

Navigating fiscal years can be confusing, especially when dealing with different organizations and their unique accounting periods. If you’re asking, “what months does fy25 include?” you’re likely seeking clarity on a specific financial timeframe. This comprehensive guide will provide a clear and detailed answer, explaining what FY25 means, its typical timeframe, potential variations, and its importance in various sectors. We aim to provide a definitive resource exceeding the value of any existing page, ensuring you understand FY25 inside and out. We will explore the standard calendar alignment, potential deviations, and address common questions with expert precision.

This guide isn’t just a calendar; it’s a roadmap to understanding the financial planning and reporting cycles that drive organizations worldwide. We’ll delve into the nuances, address frequently asked questions, and provide actionable insights to help you navigate FY25 with confidence.

## What is a Fiscal Year (FY)?

Before diving into the specific months included in FY25, it’s crucial to understand the fundamental concept of a fiscal year. A fiscal year (FY) is a 12-month period that a company or government uses for accounting and budget purposes. It doesn’t necessarily align with the calendar year (January 1st to December 31st). Instead, it’s chosen to best suit the organization’s operational cycle and financial reporting needs. For example, a retailer might have a fiscal year ending in January, after the holiday shopping season.

Different organizations use different fiscal year start and end dates. Some align with the calendar year, while others choose a different period for strategic reasons. Understanding these variations is key to answering the question, “what months does fy25 include?”

## Standard FY25 Calendar Alignment

In many cases, especially within the US Federal Government and numerous other organizations, the fiscal year follows a standard alignment. For these entities:

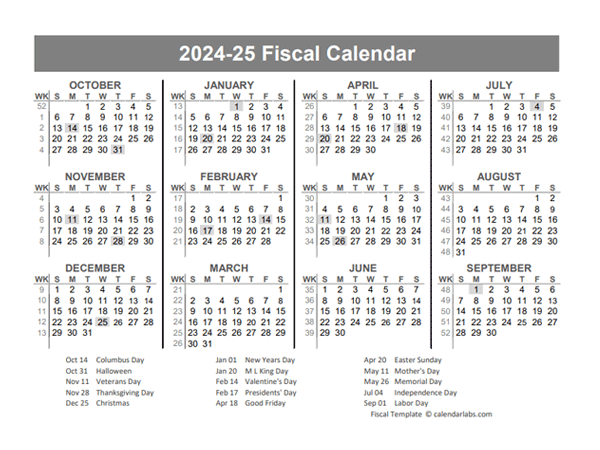

**FY25 typically runs from October 1, 2024, to September 30, 2025.**

This is the most common interpretation of FY25. Therefore, when someone asks, “what months does fy25 include,” this is the timeframe they’re usually referring to.

Here’s a breakdown of the months included:

* October 2024

* November 2024

* December 2024

* January 2025

* February 2025

* March 2025

* April 2025

* May 2025

* June 2025

* July 2025

* August 2025

* September 2025

## Potential Variations in FY25 Dates

While the October-to-September timeframe is common, it’s essential to recognize that not all organizations adhere to it. Some companies, non-profits, and even government agencies might use different fiscal year calendars. Here are some potential variations:

* **Calendar Year Alignment:** Some organizations use the calendar year (January 1 to December 31) as their fiscal year. In this case, FY25 would run from January 1, 2025, to December 31, 2025.

* **Custom Fiscal Year:** Organizations might choose a fiscal year that aligns with their specific industry or operational needs. For example, a retailer might have a fiscal year ending in January to account for the holiday shopping season. A school district may have a fiscal year aligned with the school year, starting in July or August.

To determine the specific months included in FY25 for a particular organization, it’s crucial to consult their official financial reports or contact them directly.

## Why the Fiscal Year Matters

The fiscal year is a critical concept for several reasons:

* **Budgeting and Planning:** Organizations use the fiscal year to create and manage their budgets. It provides a defined timeframe for planning expenditures and allocating resources.

* **Financial Reporting:** Companies are required to report their financial performance on a fiscal year basis. This allows investors and stakeholders to track their progress and make informed decisions.

* **Taxation:** Governments use fiscal years to collect taxes and manage public finances. The fiscal year determines when taxes are due and when government programs are funded.

* **Performance Evaluation:** Fiscal years provide a standard period for evaluating performance, identifying trends, and making strategic adjustments.

Understanding the fiscal year is essential for anyone involved in business, finance, or government. It provides a framework for understanding financial data and making informed decisions. It helps to answer questions like “what months does fy25 include?” in a meaningful context.

## How to Determine an Organization’s FY25 Dates

If you need to know the specific months included in FY25 for a particular organization, here are some steps you can take:

1. **Check Their Website:** Many organizations publish their fiscal year dates on their website, usually in the “About Us” or “Investor Relations” section.

2. **Review Financial Reports:** Publicly traded companies are required to disclose their fiscal year in their annual reports (10-K filings).

3. **Contact the Organization Directly:** If you can’t find the information online, contact the organization’s finance department or investor relations team.

4. **Industry Knowledge:** Understanding the industry the organization operates in can provide clues. For example, many schools have fiscal years starting in July.

## Understanding Federal Fiscal Years: The US Example

The United States Federal Government operates on a fiscal year that begins on October 1st and ends on September 30th. This means that FY25 for the US government spans from October 1, 2024, to September 30, 2025. This is significant because it impacts the federal budget, government spending, and numerous programs and initiatives.

Understanding the federal fiscal year is crucial for businesses that contract with the government, non-profits that receive federal funding, and anyone interested in public policy. The federal budget process is tied to the fiscal year, and major policy decisions are often made with the fiscal year in mind.

## Practical Applications of Knowing FY25 Dates

Knowing the specific months included in FY25 can be beneficial in various situations:

* **Budget Planning:** Accurately forecast income and expenses for the fiscal year.

* **Project Management:** Align project timelines with the fiscal year to ensure timely completion and funding.

* **Financial Reporting:** Prepare accurate and timely financial reports for stakeholders.

* **Grant Applications:** Meet grant deadlines and reporting requirements.

* **Investment Decisions:** Analyze financial data and make informed investment decisions.

## Common Misconceptions About Fiscal Years

There are some common misconceptions about fiscal years that can lead to confusion. Here are a few to keep in mind:

* **Fiscal Year = Calendar Year:** As mentioned earlier, the fiscal year doesn’t always align with the calendar year. Many organizations use a different timeframe.

* **All Organizations Use the Same Fiscal Year:** Different organizations can have different fiscal year dates, depending on their needs and industry.

* **The Fiscal Year is Always Based on the Gregorian Calendar:** While most do, some organizations, particularly in specific countries, might use other calendar systems for their fiscal years.

## LSI and Related Keywords for Deeper Understanding

To further enhance your understanding of fiscal years and FY25, here are some related keywords and concepts to explore:

* **Accounting Period:** A general term for any period used for accounting purposes, including fiscal years.

* **Financial Year:** Another term for fiscal year, often used interchangeably.

* **Budget Cycle:** The process of planning, approving, and managing a budget.

* **Annual Report:** A report that summarizes a company’s financial performance for a fiscal year.

* **10-K Filing:** A comprehensive financial report that publicly traded companies must file with the SEC.

* **Government Fiscal Year:** The fiscal year used by a government for budgeting and taxation purposes.

* **Fiscal Quarter:** A three-month period within a fiscal year (e.g., Q1, Q2, Q3, Q4).

* **Budgeting Software:** Software used to create and manage budgets.

* **Financial Planning:** The process of setting financial goals and developing a plan to achieve them.

* **Financial Statements:** Reports that summarize a company’s financial performance and position.

* **GAAP (Generally Accepted Accounting Principles):** The standard set of accounting rules and guidelines used in the United States.

* **IFRS (International Financial Reporting Standards):** A set of accounting standards used in many countries around the world.

* **Accrual Accounting:** An accounting method that recognizes revenue and expenses when they are earned or incurred, regardless of when cash changes hands.

* **Cash Accounting:** An accounting method that recognizes revenue and expenses when cash changes hands.

* **Depreciation:** The process of allocating the cost of an asset over its useful life.

* **Amortization:** The process of allocating the cost of an intangible asset over its useful life.

* **Tax Year:** The year used for tax purposes, which may or may not align with the fiscal year.

* **Tax Planning:** The process of minimizing tax liabilities through legal and ethical means.

* **Auditing:** The process of verifying the accuracy of financial statements.

* **Forecasting:** The process of predicting future financial performance.

* **Variance Analysis:** The process of comparing actual results to budgeted results.

* **Cost Accounting:** A branch of accounting that focuses on measuring and controlling costs.

* **Management Accounting:** A branch of accounting that provides information to managers for decision-making.

* **Fund Accounting:** A type of accounting used by non-profit organizations and government agencies.

## The Role of Technology in Managing Fiscal Years

Modern accounting software plays a crucial role in managing fiscal years. These tools automate many of the tasks associated with budgeting, financial reporting, and tax preparation. They also provide real-time insights into financial performance, allowing organizations to make informed decisions.

Examples of popular accounting software include:

* **SAP:** A comprehensive enterprise resource planning (ERP) system used by large organizations.

* **Oracle:** Another popular ERP system with a wide range of accounting and financial management features.

* **QuickBooks:** A popular accounting software for small businesses.

* **Xero:** A cloud-based accounting software that is popular among startups and small businesses.

These software solutions often include features like:

* Automated financial reporting

* Budgeting and forecasting tools

* Tax preparation assistance

* Real-time dashboards

* Integration with other business systems

## Case Study: How a Non-Profit Manages its FY25

Let’s consider a hypothetical non-profit organization, “Community Support Services,” which provides assistance to low-income families. Community Support Services operates on a fiscal year that runs from July 1 to June 30. This aligns with their grant cycles and the school year, as many of their programs are focused on supporting children and families.

For Community Support Services, FY25 runs from July 1, 2024, to June 30, 2025. During this period, they will:

* Develop and implement their annual budget.

* Track their income and expenses.

* Prepare financial reports for their board of directors and donors.

* Apply for grants to fund their programs.

* Evaluate the impact of their programs.

By carefully managing their fiscal year, Community Support Services can ensure that they are using their resources effectively and achieving their mission.

## Expert Q&A: Navigating FY25

Here are some insightful questions and expert answers related to FY25:

**Q1: What happens if an organization changes its fiscal year?**

*A: Changing a fiscal year requires careful planning and approval from the organization’s board of directors or governing body. It may also require approval from regulatory agencies. The organization will need to file a short-period report for the transition period.*

**Q2: How does the fiscal year affect government contracting?**

*A: Government contracts are often awarded and funded on a fiscal year basis. Contractors need to be aware of the government’s fiscal year to ensure that they can meet deadlines and receive timely payments.*

**Q3: What are the key differences between GAAP and IFRS in relation to fiscal year reporting?**

*A: While both GAAP and IFRS require companies to report their financial performance on a fiscal year basis, there are some differences in the specific rules and guidelines. For example, IFRS allows for more flexibility in the choice of fiscal year-end.*

**Q4: How can small businesses effectively manage their fiscal year?**

*A: Small businesses can effectively manage their fiscal year by using accounting software, creating a budget, tracking their income and expenses, and seeking advice from a qualified accountant.*

**Q5: What are the implications of a late fiscal year filing?**

*A: Late fiscal year filings can result in penalties and fines from regulatory agencies. They can also damage the organization’s reputation and make it difficult to obtain financing.*

**Q6: How does accrual accounting impact fiscal year reporting?**

*A: Accrual accounting provides a more accurate picture of an organization’s financial performance by recognizing revenue and expenses when they are earned or incurred, regardless of when cash changes hands. This can have a significant impact on fiscal year reporting.*

**Q7: What is the role of the audit committee in overseeing the fiscal year reporting process?**

*A: The audit committee is responsible for overseeing the organization’s financial reporting process, including the preparation and audit of the fiscal year financial statements. They ensure that the financial statements are accurate, reliable, and compliant with applicable accounting standards.*

**Q8: How can organizations use variance analysis to improve their fiscal year performance?**

*A: Variance analysis involves comparing actual results to budgeted results and identifying the reasons for any significant differences. By understanding these variances, organizations can take corrective action to improve their fiscal year performance.*

**Q9: What are the best practices for budgeting and forecasting for FY25?**

*A: Best practices for budgeting and forecasting include involving key stakeholders, using historical data, considering industry trends, and regularly reviewing and updating the budget.*

**Q10: How does the economic climate affect fiscal year planning?**

*A: The economic climate can have a significant impact on fiscal year planning. Organizations need to consider factors such as inflation, interest rates, and economic growth when developing their budgets and forecasts.*

## Conclusion: Mastering FY25 and Beyond

Understanding what months does fy25 include is more than just knowing a date range. It’s about grasping the underlying principles of fiscal years, their importance in organizational planning, and the potential variations that exist. Whether you’re a business owner, a financial professional, or simply someone seeking to understand the financial landscape, this guide has provided a comprehensive overview of FY25 and its implications.

Remember that the standard FY25 timeframe runs from October 1, 2024, to September 30, 2025. However, always verify the specific dates with the organization you’re interested in. By understanding the nuances of fiscal years, you can make more informed decisions and navigate the financial world with greater confidence.

Now that you have a solid understanding of FY25, we encourage you to share this knowledge with your colleagues and network. Understanding fiscal years is a critical skill for anyone involved in business or finance. Explore our other guides on related topics to further expand your financial literacy. Contact us if you have questions about your specific situation.