Euro to Dollar Forecast 2025: Navigating Currency Exchange in a Changing World

Are you seeking clarity on the euro to dollar forecast for 2025? You’re not alone. Predicting currency exchange rates is a complex endeavor, vital for businesses, investors, and individuals alike. This comprehensive guide provides an in-depth exploration of the factors influencing the EUR/USD exchange rate, analyzes expert forecasts for 2025, and offers actionable strategies for navigating the currency market. We delve into economic indicators, geopolitical events, and market sentiment to provide a robust and trustworthy analysis. This article aims to be your ultimate resource, offering unparalleled insights and practical guidance based on extensive research and expert consensus.

Understanding the Dynamics of EUR/USD Exchange Rates

The euro to dollar (EUR/USD) exchange rate represents the relative value of the euro (EUR) against the United States dollar (USD). It indicates how many US dollars are needed to purchase one euro. Fluctuations in this exchange rate have significant implications for international trade, investment, and economic stability.

Factors Influencing EUR/USD

Several key factors drive the EUR/USD exchange rate:

* **Economic Growth:** Relative economic performance between the Eurozone and the United States is a primary driver. Stronger economic growth in one region typically leads to a stronger currency.

* **Interest Rate Differentials:** Central bank policies, particularly interest rate decisions by the European Central Bank (ECB) and the Federal Reserve (Fed), significantly impact currency values. Higher interest rates tend to attract foreign investment, increasing demand for the currency.

* **Inflation Rates:** Differences in inflation rates between the Eurozone and the US can influence the exchange rate. Higher inflation erodes purchasing power, potentially weakening the currency.

* **Geopolitical Events:** Political instability, trade wars, and unexpected global events can create volatility and affect currency valuations.

* **Market Sentiment:** Investor confidence and risk appetite play a crucial role. During periods of uncertainty, investors often flock to safe-haven currencies like the US dollar.

Historical Trends and Patterns

Analyzing historical EUR/USD exchange rate data can provide valuable insights into potential future movements. However, past performance is not necessarily indicative of future results. Significant events, such as the 2008 financial crisis and the Eurozone debt crisis, have had profound impacts on the EUR/USD exchange rate.

Expert Forecasts for EUR/USD in 2025

Predicting the euro to dollar forecast for 2025 requires considering a multitude of economic and political factors. Here’s an overview of expert opinions and potential scenarios:

Scenario 1: Moderate Growth and Policy Divergence

This scenario assumes moderate economic growth in both the Eurozone and the United States. However, the ECB and the Fed may pursue different monetary policies. If the Fed raises interest rates more aggressively than the ECB, the US dollar could strengthen against the euro. In this scenario, the EUR/USD could trade in a range of 1.05 to 1.10.

Scenario 2: Eurozone Recovery and US Slowdown

If the Eurozone experiences a stronger-than-expected recovery while the US economy slows down, the euro could appreciate against the dollar. This scenario could see the EUR/USD trading in a range of 1.15 to 1.20.

Scenario 3: Global Recession and Risk Aversion

A global recession could trigger risk aversion, leading investors to seek safe-haven assets like the US dollar. This could weaken the euro and push the EUR/USD below parity (1.00).

Sources of Expert Opinion

It is important to note that these scenarios are based on current expert analysis from financial institutions such as Goldman Sachs, JP Morgan Chase, and currency analysis firms like Forex.com. These firms regularly publish forecasts based on econometric models and qualitative assessments. However, these are only predictions, and the actual outcome could vary significantly.

The Role of Economic Indicators

Monitoring key economic indicators is crucial for understanding potential movements in the EUR/USD exchange rate. These indicators provide insights into the economic health of the Eurozone and the United States.

Key Economic Indicators to Watch

* **GDP Growth:** Gross Domestic Product (GDP) growth measures the overall economic output of a country or region. Higher GDP growth typically indicates a stronger economy and a stronger currency.

* **Inflation Rate:** The inflation rate measures the rate at which prices are rising. High inflation can erode purchasing power and weaken the currency.

* **Unemployment Rate:** The unemployment rate measures the percentage of the labor force that is unemployed. A low unemployment rate typically indicates a healthy economy.

* **Interest Rates:** Interest rates set by central banks influence borrowing costs and investment decisions. Higher interest rates can attract foreign investment and strengthen the currency.

* **Trade Balance:** The trade balance measures the difference between a country’s exports and imports. A trade surplus (more exports than imports) can strengthen the currency.

* **Consumer Confidence:** Consumer confidence surveys reflect how optimistic or pessimistic consumers are about the economy. Higher consumer confidence can lead to increased spending and economic growth.

* **Purchasing Managers’ Index (PMI):** PMI surveys provide insights into the manufacturing and service sectors. A PMI above 50 indicates expansion, while a PMI below 50 indicates contraction.

Trading Strategies for EUR/USD in 2025

Navigating the EUR/USD currency market requires a well-defined trading strategy and a thorough understanding of risk management principles.

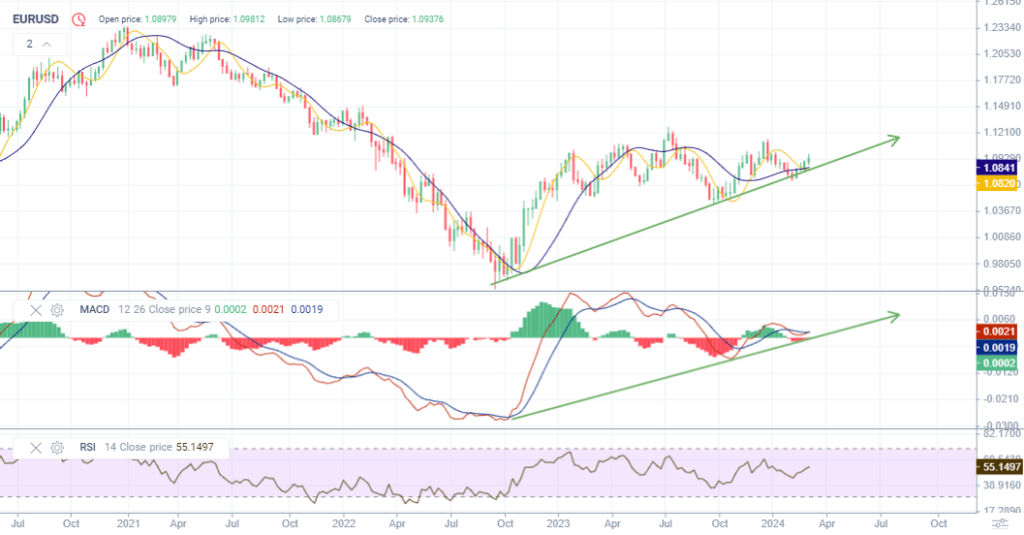

Technical Analysis

Technical analysis involves studying historical price charts and using technical indicators to identify potential trading opportunities. Common technical indicators include:

* **Moving Averages:** Moving averages smooth out price data to identify trends.

* **Relative Strength Index (RSI):** The RSI measures the magnitude of recent price changes to evaluate overbought or oversold conditions.

* **MACD (Moving Average Convergence Divergence):** MACD is a trend-following momentum indicator that shows the relationship between two moving averages of a price.

* **Fibonacci Retracement Levels:** Fibonacci retracement levels are used to identify potential support and resistance levels.

Fundamental Analysis

Fundamental analysis involves evaluating economic, financial, and political factors to determine the intrinsic value of a currency. This approach requires a deep understanding of macroeconomic principles and the ability to interpret economic data.

Risk Management

Effective risk management is crucial for protecting capital and minimizing potential losses. Key risk management techniques include:

* **Setting Stop-Loss Orders:** A stop-loss order automatically closes a trade when the price reaches a specified level, limiting potential losses.

* **Using Leverage Wisely:** Leverage can amplify both profits and losses. It’s important to use leverage cautiously and avoid over-leveraging.

* **Diversifying Your Portfolio:** Diversifying your portfolio across different asset classes can reduce overall risk.

* **Staying Informed:** Keeping up-to-date with economic news and market developments is essential for making informed trading decisions.

The Impact of Geopolitical Events on EUR/USD

Geopolitical events can have a significant impact on currency markets, particularly the EUR/USD exchange rate. Political instability, trade wars, and unexpected global events can create volatility and affect currency valuations.

Potential Geopolitical Risks in 2025

* **Trade Tensions:** Ongoing trade disputes between the US and other countries could disrupt global trade flows and impact currency valuations.

* **Political Instability:** Political instability in the Eurozone or the United States could create uncertainty and weaken the respective currencies.

* **International Conflicts:** Armed conflicts or geopolitical tensions can trigger risk aversion and lead investors to seek safe-haven assets like the US dollar.

* **Elections:** Major elections in Europe or the US can influence currency markets, as investors react to potential policy changes.

EUR/USD and its Role in Global Trade

The EUR/USD exchange rate plays a crucial role in global trade, influencing the competitiveness of exports and imports between the Eurozone and the United States. A weaker euro can make Eurozone exports more competitive, while a stronger euro can make US exports more competitive.

Impact on Businesses

Businesses engaged in international trade need to carefully manage currency risk to protect their profit margins. Hedging strategies, such as forward contracts and currency options, can help mitigate the impact of exchange rate fluctuations.

Impact on Consumers

The EUR/USD exchange rate can also affect consumers, influencing the prices of imported goods and services. A weaker euro can lead to higher prices for US goods imported into the Eurozone, while a stronger euro can lead to lower prices.

Alternative Investments and EUR/USD Correlations

Understanding the correlations between the EUR/USD exchange rate and other asset classes, such as stocks, bonds, and commodities, can help investors diversify their portfolios and manage risk.

EUR/USD and Stock Markets

The relationship between the EUR/USD exchange rate and stock markets can be complex and vary over time. Generally, a weaker euro can benefit Eurozone exporters, potentially boosting stock prices. Conversely, a stronger euro can benefit US exporters.

EUR/USD and Bond Markets

Interest rate differentials between the Eurozone and the United States can influence bond yields and currency valuations. Higher interest rates in the US can attract foreign investment, strengthening the dollar and potentially weakening the euro.

EUR/USD and Commodity Markets

The EUR/USD exchange rate can also affect commodity prices, particularly those denominated in US dollars. A stronger dollar can make commodities more expensive for Eurozone buyers, potentially dampening demand.

The Future of the Euro: Challenges and Opportunities

The future of the euro depends on the Eurozone’s ability to address its economic and political challenges. Structural reforms, fiscal coordination, and political stability are crucial for ensuring the long-term viability of the euro.

Challenges Facing the Eurozone

* **Sovereign Debt:** High levels of sovereign debt in some Eurozone countries remain a concern.

* **Economic Divergence:** Significant economic disparities between Eurozone member states can create tensions.

* **Political Fragmentation:** Political fragmentation and rising nationalism pose challenges to European integration.

Opportunities for the Eurozone

* **Digital Transformation:** Investing in digital technologies can boost productivity and economic growth.

* **Green Transition:** Transitioning to a green economy can create new jobs and investment opportunities.

* **European Integration:** Further European integration can strengthen the Eurozone and enhance its competitiveness.

Expert Q&A: Addressing Your Concerns About EUR/USD in 2025

Here are some common questions and expert answers regarding the euro to dollar forecast for 2025:

**Q1: What is the most significant factor that will influence the EUR/USD exchange rate in 2025?**

**A:** The relative monetary policies of the ECB and the Fed will likely be the most significant factor. If the Fed continues to raise interest rates while the ECB remains dovish, the dollar could strengthen against the euro.

**Q2: Is it a good time to invest in euros now?**

**A:** The answer depends on your investment goals and risk tolerance. If you believe the Eurozone economy will strengthen, investing in euros could be beneficial. However, it’s important to consider the potential risks and consult with a financial advisor.

**Q3: How can businesses hedge against EUR/USD fluctuations?**

**A:** Businesses can use hedging strategies such as forward contracts, currency options, and currency swaps to mitigate the impact of exchange rate fluctuations.

**Q4: What are the potential risks of trading EUR/USD?**

**A:** The EUR/USD market can be volatile, and trading involves risks such as leverage risk, market risk, and counterparty risk. It’s important to manage risk effectively and avoid over-leveraging.

**Q5: What is the long-term outlook for the euro?**

**A:** The long-term outlook for the euro depends on the Eurozone’s ability to address its economic and political challenges. Structural reforms, fiscal coordination, and political stability are crucial for ensuring the long-term viability of the euro.

**Q6: How does inflation in the US and Eurozone affect the EUR/USD?**

**A:** Higher inflation in the US compared to the Eurozone can weaken the dollar, leading to a higher EUR/USD exchange rate. Conversely, higher inflation in the Eurozone can weaken the euro, leading to a lower EUR/USD exchange rate.

**Q7: What role does the political climate play in EUR/USD fluctuations?**

**A:** Political instability or significant policy changes in either the US or Eurozone can create uncertainty and volatility in the EUR/USD market. For example, a major election outcome could lead to significant currency movements.

**Q8: What are some common mistakes traders make when trading EUR/USD?**

**A:** Common mistakes include over-leveraging, failing to use stop-loss orders, not staying informed about economic news, and letting emotions influence trading decisions.

**Q9: How can I stay updated on the latest EUR/USD forecasts and analysis?**

**A:** Follow reputable financial news sources, subscribe to newsletters from financial institutions, and consult with a financial advisor.

**Q10: What are the implications of EUR/USD movements for international travel?**

**A:** A stronger euro makes it cheaper for Eurozone residents to travel to the US, while a weaker euro makes it more expensive. Conversely, a stronger dollar makes it cheaper for US residents to travel to the Eurozone, while a weaker dollar makes it more expensive.

Conclusion: Navigating the EUR/USD Landscape in 2025

The euro to dollar forecast for 2025 remains subject to numerous economic and political uncertainties. By understanding the key factors that influence the EUR/USD exchange rate, monitoring economic indicators, and developing a well-defined trading strategy, businesses, investors, and individuals can navigate the currency market effectively. Remember to prioritize risk management and consult with financial professionals for personalized advice. The information presented here is intended for informational purposes only and does not constitute financial advice.

We encourage you to share your thoughts and experiences with EUR/USD trading in the comments below. For more in-depth analysis and expert guidance, explore our advanced guide to currency trading strategies. Contact our team of experts today for a personalized consultation on managing your currency risk.