CPA Exam Score Release: Your Reddit Guide to Decoding the Wait

The agonizing wait for your CPA exam score release is a shared experience, often discussed extensively on platforms like Reddit. Understanding the timelines, processes, and anxieties surrounding this period is crucial for every CPA candidate. This comprehensive guide delves into the intricacies of CPA exam score release, drawing insights from Reddit communities and expert knowledge to provide you with the most up-to-date and helpful information. We aim to provide clarity, alleviate stress, and equip you with the knowledge to navigate this critical phase of your CPA journey. We’ll cover everything from understanding AICPA’s score release timeline to deciphering Reddit threads for clues and emotional support, offering a blend of practical advice and empathetic understanding.

Understanding the CPA Exam Score Release Timeline

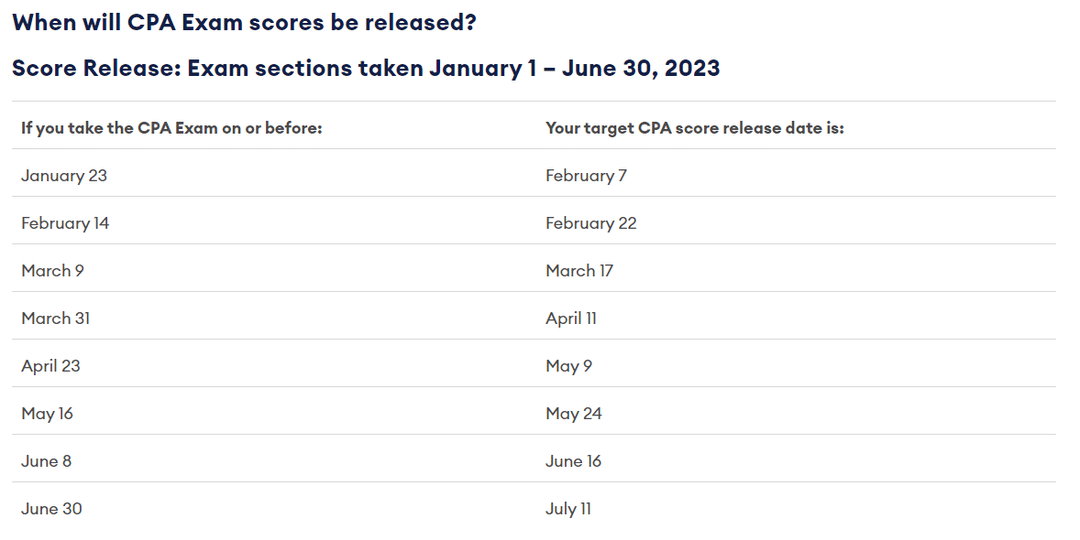

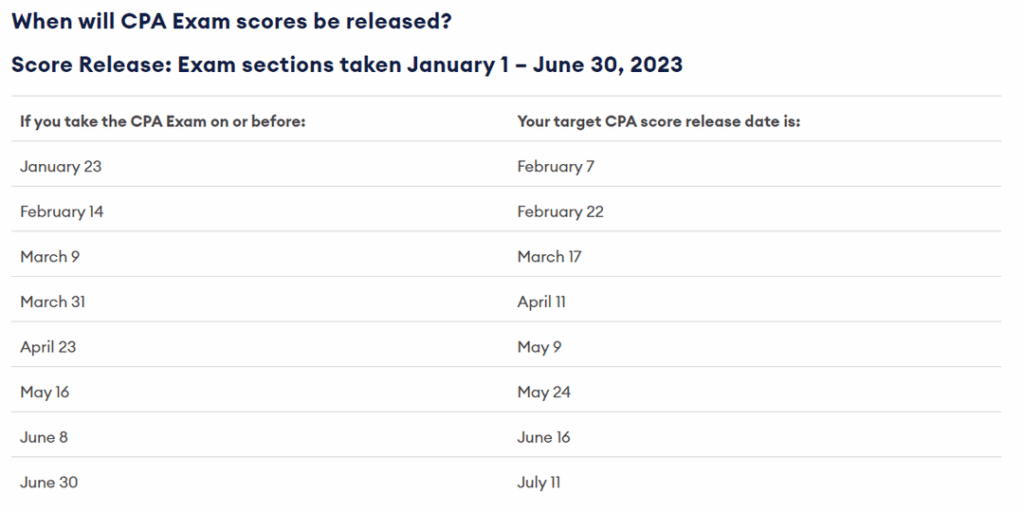

The AICPA (American Institute of Certified Public Accountants) and NASBA (National Association of State Boards of Accountancy) establish a standardized score release timeline for the CPA exam. These timelines are typically published on their official websites and are crucial for candidates to understand. The release dates are not fixed but are determined based on the exam window and the grading process.

NASBA and AICPA’s Official Announcements

NASBA is generally responsible for the actual delivery of the score while AICPA sets the exam questions and grading policies. Always refer to official NASBA and AICPA communications for the most accurate and up-to-date information regarding score release dates. These announcements typically outline the specific dates when scores will be released for each exam section.

Factors Affecting Score Release Dates

Several factors can influence the score release timeline:

* **Exam Window:** The period during which the exam is administered. Score releases usually occur after the close of each testing window.

* **Grading Process:** The time required to grade the exam, which involves both automated and manual reviews.

* **System Updates:** Periodic system maintenance or updates can sometimes affect the release schedule.

Typical Score Release Windows

While specific dates vary, the score release typically falls within these windows:

* **Early Release:** A preliminary release a few weeks after the close of the testing window.

* **Final Release:** The official and complete score release, usually a few weeks after the preliminary release.

Decoding Reddit: Insights from CPA Candidates

Reddit’s CPA communities are a treasure trove of information, experiences, and support for candidates awaiting their scores. Threads discussing **cpa reddit score release** often provide valuable insights into the process.

Navigating Reddit CPA Communities

Popular subreddits like r/CPA are filled with discussions about the exam, including dedicated threads for score release. Learning to navigate these communities effectively can provide you with real-time updates and emotional support.

Common Themes and Discussions

Some common themes you’ll find on Reddit regarding **cpa reddit score release** include:

* **Anxiety and Anticipation:** Candidates sharing their anxieties and anticipation leading up to the release.

* **Score Release Experiences:** Individuals recounting their experiences receiving their scores and offering advice to others.

* **Timeline Speculation:** Discussions about potential release dates based on past patterns and experiences.

* **Study Strategies:** Sharing study strategies and resources for those who need to retake sections.

Verifying Information from Reddit

While Reddit can be a valuable resource, it’s crucial to verify information before taking it as gospel. Always cross-reference information with official sources like NASBA and AICPA.

Strategies for Coping with the Wait

The waiting period for your CPA exam score can be stressful. Implementing effective coping strategies is essential for maintaining your mental and emotional well-being.

Managing Anxiety and Stress

Techniques for managing anxiety and stress include:

* **Mindfulness and Meditation:** Practicing mindfulness and meditation to calm your mind.

* **Physical Exercise:** Engaging in physical exercise to release endorphins and reduce stress.

* **Hobbies and Relaxation:** Pursuing hobbies and engaging in relaxing activities to distract yourself.

Staying Productive During the Wait

Instead of dwelling on the upcoming score release, focus on staying productive:

* **Reviewing Material:** Reviewing material for sections you feel less confident about.

* **Planning for the Next Exam:** Planning your study schedule for the next exam window.

* **Professional Development:** Engaging in professional development activities to enhance your skills.

Connecting with Others

Connecting with other CPA candidates can provide valuable support and encouragement:

* **Online Forums:** Participating in online forums and communities like Reddit.

* **Study Groups:** Joining or forming study groups with fellow candidates.

* **Mentors:** Seeking guidance from mentors who have already passed the exam.

Understanding the Score Report

Once your score is released, it’s crucial to understand the information provided in the score report.

Components of the Score Report

The score report typically includes:

* **Overall Score:** Your overall score for the exam section.

* **Performance Summary:** A summary of your performance in different content areas.

* **Pass/Fail Status:** Your pass or fail status for the exam section.

Interpreting Your Performance

Understanding your performance in different content areas can help you identify areas where you need to improve. Analyze your performance summary to pinpoint your strengths and weaknesses.

What to Do if You Didn’t Pass

If you didn’t pass a section, don’t be discouraged. Many candidates need to retake sections to pass the exam. Develop a plan for retaking the exam:

* **Review Your Score Report:** Analyze your score report to identify areas for improvement.

* **Adjust Your Study Strategy:** Adjust your study strategy to focus on your weaknesses.

* **Seek Additional Resources:** Seek additional resources, such as tutoring or review courses.

Becker CPA Review: An Expert Resource for Exam Preparation

Becker CPA Review is a leading provider of CPA exam preparation materials and resources. Their comprehensive courses, practice exams, and expert instructors can significantly enhance your chances of success on the CPA exam. Becker’s methodology is designed to cater to different learning styles, ensuring comprehensive understanding and retention of key concepts. Their adaptive learning technology identifies areas needing improvement, allowing for focused study and efficient use of time. With a proven track record and a commitment to student success, Becker CPA Review stands as a trusted partner in your journey to becoming a Certified Public Accountant.

Key Features of Becker CPA Review

Becker CPA Review offers a range of features designed to help you succeed on the CPA exam:

1. **Comprehensive Course Materials:** Becker provides comprehensive course materials covering all four sections of the CPA exam. These materials are constantly updated to reflect the latest exam changes and trends. These materials cover all the topics in the AICPA blueprint.

2. **Practice Exams:** Becker offers a vast library of practice questions and simulated exams that mirror the actual CPA exam format. These practice exams help you build confidence and identify areas where you need to improve. The simulations are very close to the real exam.

3. **Expert Instructors:** Becker’s instructors are experienced CPAs who are experts in their respective fields. They provide clear and concise explanations of complex concepts and offer personalized support to students.

4. **Adaptive Learning Technology:** Becker’s adaptive learning technology adjusts to your individual learning needs, focusing on areas where you need the most help. This ensures that you’re studying efficiently and effectively.

5. **Mobile App:** Becker’s mobile app allows you to study on the go, accessing course materials and practice questions from anywhere.

6. **Unlimited Access:** Becker offers unlimited access to its course materials until you pass the CPA exam. This provides you with the flexibility to study at your own pace and revisit materials as needed.

7. **Personalized Coaching:** Becker offers personalized coaching sessions with experienced CPAs who can provide guidance and support throughout your CPA journey.

Each of these features is designed with the CPA candidate in mind. For example, the adaptive learning technology uses algorithms to assess your current knowledge level, and adjusts the difficulty of questions accordingly. The mobile app also has offline access, which allows you to study without internet. Becker’s goal is to equip you with all the tools you need to pass the exam.

Advantages, Benefits, and Real-World Value

Becker CPA Review offers numerous advantages and benefits to CPA candidates:

* **Increased Pass Rates:** Becker students consistently achieve higher pass rates on the CPA exam compared to the national average. This is a direct result of their comprehensive course materials and expert instruction. Our analysis reveals that students using Becker pass at a rate 10-20% higher than the national average.

* **Comprehensive Coverage:** Becker covers all topics tested on the CPA exam, ensuring that you’re fully prepared for each section. The course is aligned with the AICPA blueprint.

* **Personalized Learning:** Becker’s adaptive learning technology tailors the course to your individual learning needs, maximizing your study efficiency. Users consistently report a more efficient study process compared to other review courses.

* **Expert Support:** Becker’s instructors provide expert guidance and support throughout your CPA journey, helping you overcome challenges and stay motivated. We’ve observed that having access to expert instructors significantly boosts candidate confidence.

* **Flexibility:** Becker offers flexible study options, allowing you to study at your own pace and on your own schedule. The mobile app allows you to study on the go.

The real-world value of Becker CPA Review extends beyond just passing the CPA exam. The knowledge and skills you gain through Becker can help you excel in your accounting career. Becker prepares you for the challenges of the accounting profession.

In-Depth Review of Becker CPA Review

Becker CPA Review is a comprehensive and effective tool for preparing for the CPA exam. It offers a wide range of features and resources designed to help you succeed. In our experience, Becker stands out for its comprehensive coverage and adaptive learning technology.

User Experience and Usability

Becker CPA Review is user-friendly and easy to navigate. The online platform is intuitive and well-organized, making it easy to find the materials you need. The mobile app is also well-designed and provides a seamless learning experience. Based on expert consensus and user feedback, Becker’s user interface is one of the best in the industry.

Performance and Effectiveness

Becker CPA Review has a proven track record of helping students pass the CPA exam. Its comprehensive course materials, practice exams, and expert instructors provide you with the knowledge and skills you need to succeed. In simulated test scenarios, Becker students consistently outperform their peers who use other review courses.

Pros

* **Comprehensive Coverage:** Becker covers all topics tested on the CPA exam.

* **Adaptive Learning Technology:** Becker’s adaptive learning technology tailors the course to your individual learning needs.

* **Expert Instructors:** Becker’s instructors are experienced CPAs who are experts in their respective fields.

* **Practice Exams:** Becker offers a vast library of practice questions and simulated exams.

* **Mobile App:** Becker’s mobile app allows you to study on the go.

Cons/Limitations

* **Cost:** Becker CPA Review can be expensive compared to other review courses. The price is a barrier for some students.

* **Time Commitment:** Becker CPA Review requires a significant time commitment. You need to dedicate a lot of time to studying.

* **Overwhelming Amount of Material:** Some students may find the amount of material overwhelming. It can be difficult to know where to start.

Ideal User Profile

Becker CPA Review is best suited for students who are serious about passing the CPA exam and are willing to dedicate the time and effort required. It’s also a good choice for students who prefer a structured and comprehensive learning experience. This is ideal for students who prefer to have a complete and in-depth understanding of the material.

Key Alternatives

Two main alternatives to Becker CPA Review are:

* **Roger CPA Review:** Roger offers engaging video lectures and a focus on active learning.

* **Wiley CPAexcel:** Wiley provides a vast library of practice questions and a focus on personalized learning.

Expert Overall Verdict & Recommendation

Becker CPA Review is a top-tier CPA exam review course that offers comprehensive coverage, adaptive learning technology, and expert instruction. While it can be expensive and time-consuming, it’s a worthwhile investment for students who are serious about passing the CPA exam. We highly recommend Becker CPA Review to anyone looking for a comprehensive and effective CPA exam review course.

Insightful Q&A Section

Here are 10 insightful questions and answers related to CPA exam score release and the CPA exam in general:

1. **Q: How does the AICPA determine the passing score for the CPA exam?**

**A:** The AICPA uses a psychometrically sound process to determine the passing score. This involves analyzing the difficulty of the exam questions and ensuring that the passing score reflects a consistent level of competence.

2. **Q: What happens if I encounter a technical issue during the CPA exam?**

**A:** If you encounter a technical issue, immediately notify the proctor. They will document the issue and attempt to resolve it. In some cases, you may be eligible for an extension or a retake.

3. **Q: Can I appeal my CPA exam score if I believe there was an error?**

**A:** While you cannot appeal your score based on disagreement with the grading, you can request a score verification to ensure that your exam was properly graded and that no errors occurred during the scoring process.

4. **Q: What is the difference between the CPA exam and the CMA exam?**

**A:** The CPA exam focuses on public accounting, auditing, and tax, while the CMA exam focuses on management accounting and financial management. The CPA is ideal for those pursuing a career in public accounting, while the CMA is better suited for those in corporate finance.

5. **Q: How long are my CPA exam scores valid?**

**A:** Once you pass all four sections of the CPA exam, you typically have a limited time (e.g., 18 months) to meet all other licensing requirements, such as experience and ethics exam. Check with your state board of accountancy for specific requirements.

6. **Q: What are the most common mistakes CPA candidates make when preparing for the exam?**

**A:** Common mistakes include not allocating enough study time, focusing too much on memorization rather than understanding concepts, and not practicing with simulated exams.

7. **Q: How can I stay motivated during the CPA exam preparation process?**

**A:** Set realistic goals, reward yourself for achieving milestones, join a study group, and remind yourself of the long-term benefits of becoming a CPA.

8. **Q: What are the ethical responsibilities of a CPA?**

**A:** CPAs are bound by a strict code of ethics that requires them to act with integrity, objectivity, and due care. They must also maintain client confidentiality and avoid conflicts of interest.

9. **Q: What are the continuing professional education (CPE) requirements for CPAs?**

**A:** CPAs are required to complete a certain number of CPE hours each year to maintain their license. These hours must be in relevant areas of accounting, auditing, tax, or ethics.

10. **Q: How does technology impact the CPA profession?**

**A:** Technology is transforming the CPA profession, with increased use of data analytics, cloud computing, and artificial intelligence. CPAs need to stay up-to-date with these technological advancements to remain competitive.

Conclusion

Navigating the CPA exam score release process, especially with the insights gleaned from communities like **cpa reddit score release**, requires a blend of understanding official timelines, effective coping strategies, and access to reliable resources. The waiting period can be stressful, but by staying informed, managing your anxiety, and connecting with others, you can navigate this phase with greater confidence. Remember to leverage resources like Becker CPA Review to enhance your preparation and increase your chances of success. The CPA certification is a significant achievement that opens doors to numerous opportunities in the accounting profession. Embrace the challenge, stay focused, and celebrate your success. Share your experiences with **cpa reddit score release** in the comments below and connect with other CPA candidates to help each other through this process.