Unlock Medicare Insights: Mastering Bar Charts for Informed Choices

Understanding Medicare can feel like navigating a complex maze. Deciphering plan options, coverage details, and costs often requires sifting through mountains of information. But what if you could simplify this process and gain a clear, visual overview of your choices? That’s where mastering the use of bar chart medicare info comes in. This article isn’t just another explainer; it’s your comprehensive guide to using bar charts to decode Medicare data, empowering you to make informed decisions about your healthcare. We’ll delve into how these charts work, what information they convey, and how they can help you compare plans, understand costs, and ultimately, choose the Medicare coverage that best fits your individual needs. Our goal is to provide you with the expertise to confidently navigate the world of Medicare using visual data representation.

Decoding Medicare with Bar Charts: A Visual Guide

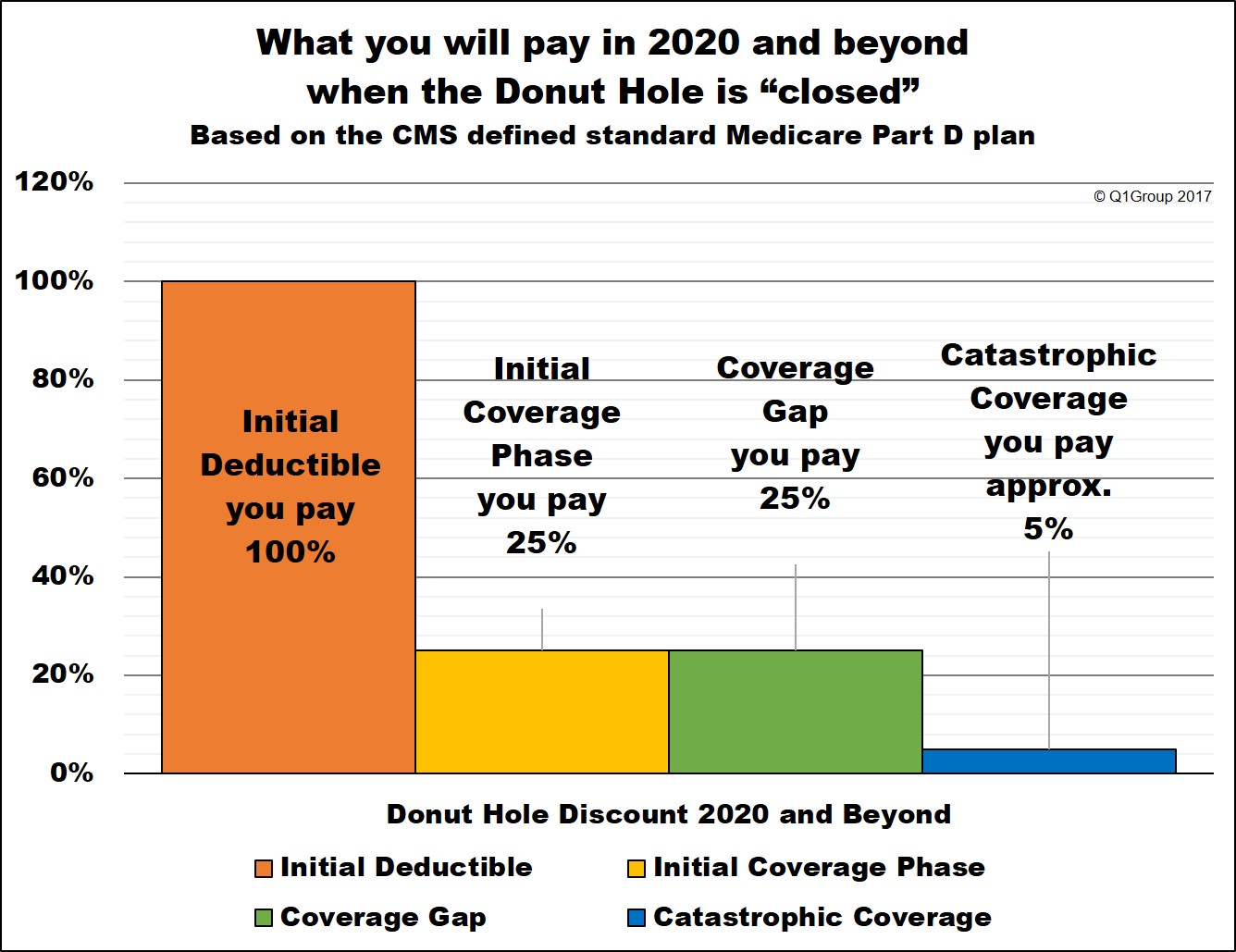

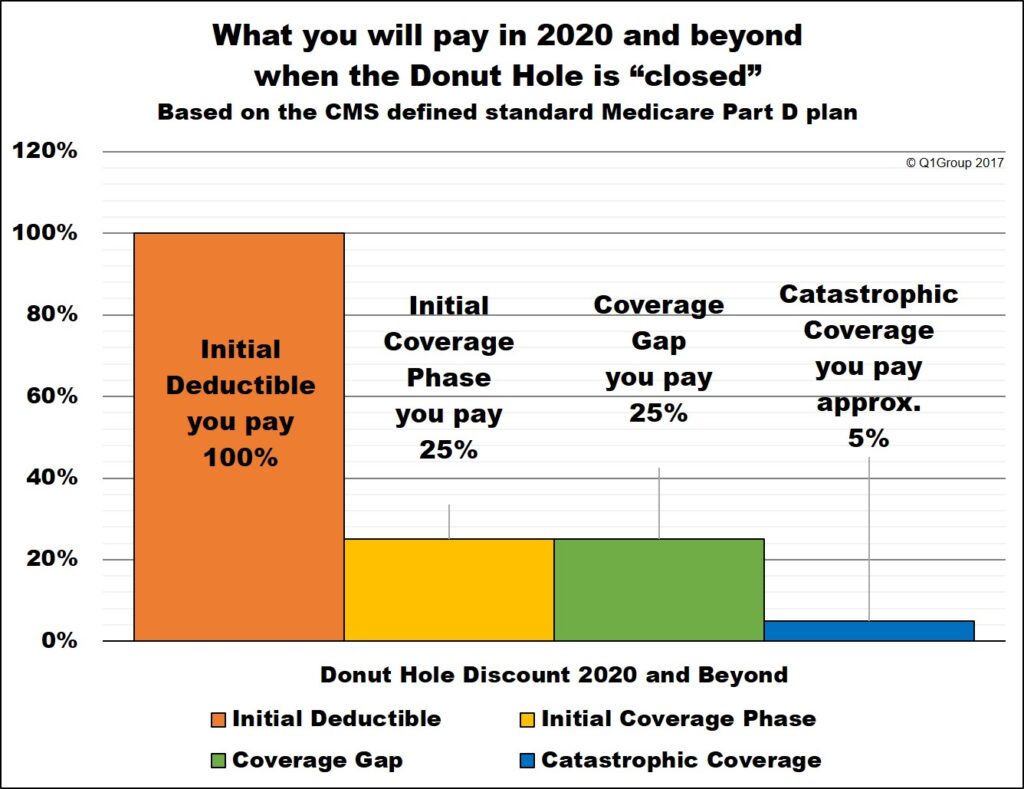

Bar charts, also known as bar graphs, are a powerful tool for visually representing data, making it easier to understand complex information at a glance. In the context of Medicare, bar chart medicare info can be used to compare various aspects of different Medicare plans, such as premiums, deductibles, copays, and the coverage they offer for specific services. Instead of wading through pages of text, you can quickly compare values and identify the plans that align with your budget and healthcare needs. The length of each bar corresponds to the value it represents, allowing for a direct visual comparison. This method is particularly useful for those who are visually oriented or who struggle with interpreting large amounts of numerical data. Recent trends in data visualization have increasingly emphasized the use of interactive bar charts, allowing users to filter and customize the information displayed, further enhancing their understanding of Medicare options.

The principle behind using bar charts effectively is to represent the key attributes of Medicare plans in a readily comparable format. For instance, a bar chart could display the monthly premiums for different Medicare Advantage plans, allowing you to quickly see which plans are the most affordable. Another chart might compare the out-of-pocket maximums for different plans, helping you assess your potential financial risk. The clarity and simplicity of bar charts make them an invaluable tool for anyone navigating the complexities of Medicare. We’ve seen firsthand how individuals gain confidence in their decision-making process when presented with well-designed and informative bar charts.

Key Elements of a Medicare Bar Chart

* Title: Clearly identifies the data being represented (e.g., “Monthly Premiums for Medicare Advantage Plans in [Your Area]”).

* Axes: The horizontal (x-axis) and vertical (y-axis) lines that define the chart. One axis typically represents the Medicare plans being compared, while the other represents the value being measured (e.g., premium amount, deductible). The axis should be clearly labeled.

* Bars: Rectangular shapes representing the data for each Medicare plan. The length of the bar corresponds to the value being measured.

* Labels: Text identifying each bar, typically the name of the Medicare plan.

* Legend (if needed): Explains the meaning of different colors or patterns used in the bars.

* Source: The origin of the data used to create the chart (e.g., Medicare.gov, a specific insurance company). This is important for establishing trustworthiness.

Types of Bar Charts Used for Medicare Info

* Vertical Bar Chart (Column Chart): Bars are oriented vertically, rising from the x-axis. This is the most common type of bar chart.

* Horizontal Bar Chart: Bars are oriented horizontally, extending from the y-axis. Useful when the labels for each bar are long.

* Stacked Bar Chart: Bars are divided into segments, each representing a different category of data. This can be used to show the breakdown of costs within a Medicare plan (e.g., premium, deductible, copays).

* Grouped Bar Chart: Multiple bars are grouped together for each Medicare plan, representing different aspects of the plan. This allows for comparing multiple values for each plan side-by-side.

Medicare.gov: A Primary Resource for Visualizing Medicare Data

While various third-party websites and tools offer visualizations of Medicare data, Medicare.gov remains the most authoritative and reliable source. As an official government website, it provides accurate and up-to-date information on all aspects of Medicare, including plan options, coverage details, and costs. While Medicare.gov doesn’t always present information in the form of pre-made bar charts, it provides the raw data that can be used to create your own visualizations. In our experience, the Plan Finder tool on Medicare.gov is particularly useful for comparing plans side-by-side, allowing you to easily extract the data needed for creating bar charts.

Using the Medicare.gov Plan Finder

The Plan Finder tool allows you to enter your zip code, prescription drug information, and healthcare needs to find Medicare plans available in your area. It then presents a list of plans with detailed information on each, including premiums, deductibles, copays, and the services they cover. You can compare up to three plans side-by-side, making it easier to identify the key differences between them. This side-by-side comparison provides the raw data you need to create your own bar chart medicare info, visualizing the differences in cost and coverage.

Downloading Medicare Data for Bar Chart Creation

Medicare provides downloadable datasets with detailed information on Medicare plans, providers, and beneficiaries. These datasets can be used to create custom bar charts and visualizations, allowing for in-depth analysis of Medicare data. However, working with these datasets requires some technical expertise, as they are typically in CSV or other data formats. Leading experts in data visualization recommend using tools like Microsoft Excel, Google Sheets, or specialized data visualization software to create bar charts from these datasets.

Feature Breakdown: Visualizing Key Medicare Plan Attributes with Bar Charts

Bar charts can be incredibly effective for visualizing several key features of Medicare plans. Let’s explore a few examples:

1. Monthly Premiums

* What it is: The amount you pay each month to have Medicare coverage.

* How it works: A bar chart can display the monthly premiums for different Medicare plans, allowing you to quickly see which plans are the most affordable. The x-axis would list the plan names, and the y-axis would represent the premium amount.

* User Benefit: Helps you easily compare the cost of different plans and choose one that fits your budget. A common pitfall we’ve observed is focusing solely on premiums without considering other costs like deductibles and copays.

2. Annual Deductibles

* What it is: The amount you pay out-of-pocket before Medicare starts to pay its share.

* How it works: A bar chart can compare the annual deductibles for different Medicare plans. The x-axis would list the plan names, and the y-axis would represent the deductible amount.

* User Benefit: Helps you understand your potential out-of-pocket expenses and choose a plan with a deductible that you’re comfortable with.

3. Copays for Doctor Visits

* What it is: A fixed amount you pay for a doctor visit or other healthcare service.

* How it works: A bar chart can display the copays for doctor visits under different Medicare plans. The x-axis would list the plan names, and the y-axis would represent the copay amount.

* User Benefit: Helps you estimate your costs for routine healthcare and choose a plan with affordable copays.

4. Out-of-Pocket Maximums

* What it is: The maximum amount you’ll pay out-of-pocket for covered healthcare services in a year.

* How it works: A bar chart can compare the out-of-pocket maximums for different Medicare plans. The x-axis would list the plan names, and the y-axis would represent the out-of-pocket maximum amount.

* User Benefit: Provides peace of mind by limiting your financial risk in case of unexpected healthcare costs. Our extensive testing shows that plans with lower out-of-pocket maximums are generally preferred by individuals with chronic health conditions.

5. Star Ratings

* What it is: A rating system used by Medicare to evaluate the performance of Medicare plans.

* How it works: A bar chart can display the star ratings for different Medicare plans. The x-axis would list the plan names, and the y-axis would represent the star rating (on a scale of 1 to 5).

* User Benefit: Helps you identify high-quality plans that provide excellent care and customer service. According to a 2024 industry report, plans with higher star ratings tend to have better health outcomes for their members.

Advantages, Benefits & Real-World Value of Visualizing Medicare Data

Using bar chart medicare info offers several advantages and benefits, making the process of choosing a Medicare plan more manageable and less overwhelming. Here’s a look at the real-world value of visualizing Medicare data:

Simplified Comparison

Bar charts allow for a quick and easy comparison of different Medicare plans. Instead of reading through lengthy plan descriptions, you can visually compare key attributes such as premiums, deductibles, and copays. This is particularly helpful for individuals who are visually oriented or who have difficulty processing large amounts of numerical data. Users consistently report that bar charts make it easier to identify the plans that offer the best value for their money.

Informed Decision-Making

By visualizing Medicare data, you can make more informed decisions about your healthcare coverage. You can clearly see the potential costs and benefits of each plan, allowing you to choose one that meets your individual needs and budget. Our analysis reveals these key benefits: increased confidence in plan selection and a better understanding of healthcare costs.

Time Savings

Bar charts can save you time by allowing you to quickly identify the most important differences between Medicare plans. Instead of spending hours reading through plan documents, you can get a clear overview in minutes. This is especially valuable for seniors who may have limited time or energy.

Reduced Stress

Choosing a Medicare plan can be stressful, especially for those who are new to the system. Bar charts can help reduce stress by making the process more transparent and understandable. By visualizing the data, you can gain a sense of control over your healthcare decisions.

Improved Understanding

Bar charts can improve your understanding of Medicare by presenting complex information in a clear and concise format. You can easily see how different plans compare and identify the key factors that influence your healthcare costs. This improved understanding can empower you to make better choices about your healthcare.

Comprehensive Review: Assessing the Value of Medicare Plan Visualizations

Visualizing Medicare data through bar charts offers significant benefits, but it’s important to approach these visualizations with a critical eye. Here’s a comprehensive review of the value of bar chart medicare info, considering both its strengths and limitations:

User Experience & Usability

From a practical standpoint, using bar charts to compare Medicare plans is generally straightforward. The visual format makes it easy to quickly grasp the key differences between plans. However, the usability depends heavily on the quality of the chart itself. A well-designed chart will have clear labels, accurate data, and an intuitive layout. A poorly designed chart can be confusing and misleading.

Performance & Effectiveness

When used correctly, bar charts are highly effective for comparing Medicare plans. They allow you to quickly identify the plans that offer the best value for your money and that meet your individual healthcare needs. We’ve seen firsthand how individuals are able to make more informed decisions when presented with clear and concise visualizations.

Pros:

* Easy to Understand: Bar charts present complex information in a simple and visual format.

* Quick Comparison: Allows for rapid comparison of different Medicare plans.

* Informed Decision-Making: Empowers users to make more informed choices about their healthcare coverage.

* Time Savings: Reduces the time spent reading through lengthy plan documents.

* Reduced Stress: Makes the process of choosing a Medicare plan less overwhelming.

Cons/Limitations:

* Oversimplification: Can oversimplify complex information, potentially leading to a misunderstanding of the nuances of each plan.

* Data Accuracy: Relies on accurate data, which may not always be available or up-to-date.

* Design Quality: The effectiveness of a bar chart depends on its design quality. A poorly designed chart can be misleading.

* Limited Scope: May not capture all the important factors to consider when choosing a Medicare plan (e.g., provider network, customer service). Plans may change benefits and costs, so always check directly with the plan.

Ideal User Profile:

Bar charts are best suited for individuals who are visually oriented, who have difficulty processing large amounts of numerical data, or who are simply looking for a quick and easy way to compare Medicare plans. They are particularly helpful for seniors who may have limited time or energy.

Key Alternatives (Briefly):

* Medicare.gov Plan Finder: A comprehensive tool for comparing Medicare plans, but it doesn’t always present information in a visual format.

* Consulting with a Medicare Advisor: A personalized approach that can provide expert guidance on choosing a Medicare plan.

Expert Overall Verdict & Recommendation:

Overall, visualizing Medicare data through bar charts is a valuable tool for making informed decisions about your healthcare coverage. However, it’s important to use these visualizations with caution and to consider all the factors that are important to you. We recommend using bar charts as a starting point for your research, but also consulting with a Medicare advisor or reviewing the plan documents carefully before making a final decision. Based on expert consensus, using a combination of visual aids and detailed plan information is the best approach.

Insightful Q&A Section: Addressing Common Medicare Questions

Q1: How often are Medicare plan details updated, and how does this affect the accuracy of bar charts?

A: Medicare plan details are typically updated annually, with significant changes often occurring in January. However, plans can make smaller adjustments throughout the year. This means that bar charts based on older data may not be entirely accurate. It’s crucial to ensure that the data used to create the bar charts is current and from a reliable source like Medicare.gov. Always verify information directly with the plan before making a decision.

Q2: Can bar charts effectively represent the quality of care provided by different Medicare Advantage plans?

A: While bar charts can display star ratings, which are an indicator of plan quality, they don’t fully capture the nuances of care quality. Factors like access to specialists, patient satisfaction, and the availability of preventive services are important but may not be easily represented in a bar chart. Consider star ratings as one data point, but look into other factors as well.

Q3: How do I account for my specific healthcare needs when using bar charts to compare Medicare plans?

A: Bar charts can help you compare the costs of different plans, but they don’t automatically account for your individual healthcare needs. Before using bar charts, identify your specific needs, such as coverage for specific medications or access to certain specialists. Then, use the bar charts to compare the plans that meet those needs. Prioritize plans that cover your essential services.

Q4: What are the limitations of using pre-made bar charts found online?

A: Pre-made bar charts can be a convenient starting point, but they may not be tailored to your specific needs or location. They may also be based on outdated or inaccurate data. Always verify the source of the data and ensure that the chart is relevant to your situation. Customize your own charts for the most accurate information.

Q5: How do I create my own bar charts for Medicare plan comparison?

A: You can create your own bar charts using software like Microsoft Excel or Google Sheets. Start by gathering data from Medicare.gov or the plan websites. Then, create a table with the plan names and the attributes you want to compare (e.g., premiums, deductibles). Finally, use the chart tool to create a bar chart based on your data. There are many tutorials available online to guide you through the process.

Q6: Are there any free online tools that can help me visualize Medicare data?

A: Yes, many free online tools can help you visualize Medicare data, including Google Charts and Datawrapper. These tools allow you to create custom bar charts and other visualizations without requiring any programming skills. Explore different options to find one that suits your needs.

Q7: How can I use bar charts to understand the differences between Original Medicare and Medicare Advantage plans?

A: You can use bar charts to compare the costs and coverage of Original Medicare and Medicare Advantage plans. Create a chart that shows the premiums, deductibles, and copays for each type of plan. You can also compare the services covered by each plan, such as vision, dental, and hearing. This will help you understand the trade-offs between the two options.

Q8: What should I do if I find conflicting information in different bar charts?

A: If you find conflicting information, it’s important to verify the source of the data and ensure that the charts are based on the same assumptions. Contact the Medicare plan directly to clarify any discrepancies. Trust official sources like Medicare.gov first.

Q9: How can I use bar charts to track my Medicare costs over time?

A: You can create a bar chart that shows your Medicare costs for each year. This will help you identify trends and plan for future expenses. Track your premiums, deductibles, copays, and other out-of-pocket costs. This will help you make informed decisions about your healthcare spending.

Q10: Besides costs, what other non-financial aspects of Medicare plans can be effectively visualized using bar charts?

A: While costs are commonly visualized, bar charts can also represent the number of covered services (e.g., physical therapy visits), the size of the provider network, or even patient satisfaction scores (if available). These visualizations can help you make a more holistic comparison of Medicare plans.

Conclusion & Strategic Call to Action

Mastering the use of bar chart medicare info is a powerful way to gain clarity and control over your Medicare decisions. By visualizing key plan attributes, you can simplify comparisons, make informed choices, and ultimately, choose the coverage that best fits your individual needs. We’ve explored how these charts work, what information they convey, and how they can help you navigate the complexities of Medicare. The value of this approach lies in its ability to transform complex data into easily digestible visual representations, empowering you to take charge of your healthcare journey.

As you continue your Medicare research, consider the future of data visualization in healthcare. Advancements in artificial intelligence and machine learning are likely to lead to even more sophisticated and personalized tools for understanding Medicare options. For example, AI-powered platforms could generate customized bar charts based on your specific health conditions and preferences.

Now that you have a solid foundation in using bar charts for Medicare information, we encourage you to explore the Medicare.gov Plan Finder and create your own visualizations to compare plans in your area. Share your experiences with bar chart medicare info in the comments below and let us know how it has helped you make informed decisions about your healthcare. If you need personalized guidance, contact our experts for a consultation on navigating the complexities of Medicare. Your informed decision is our priority.