Navigating the 2025 Target-Date Strategy Landscape: A Comprehensive Guide

The 2025 target-date strategy landscape is rapidly evolving, presenting both opportunities and challenges for investors and financial professionals alike. Understanding this landscape is crucial for making informed decisions and achieving long-term financial goals. This comprehensive guide provides an in-depth exploration of the key trends, strategies, and considerations shaping the 2025 target-date fund (TDF) environment. We’ll delve into the nuances of asset allocation, risk management, and the impact of market volatility on these critical retirement savings vehicles. We aim to equip you with the knowledge and insights needed to navigate this complex terrain effectively, ensuring your retirement plans are well-positioned for success.

Understanding the Evolving 2025 Target-Date Strategy Landscape

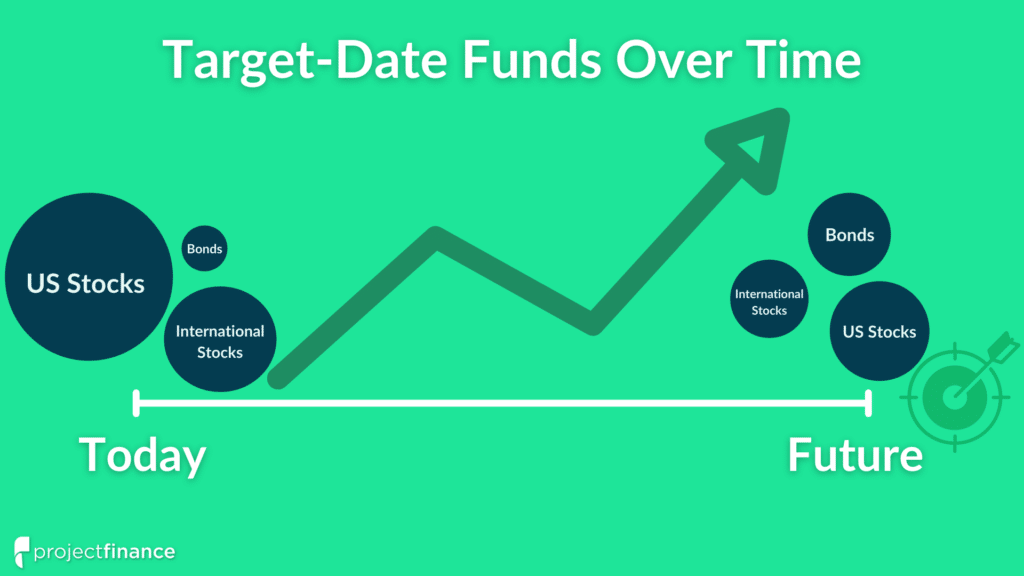

Target-date funds (TDFs) have become a cornerstone of retirement savings, offering a simplified, hands-off approach to investing. These funds are designed to become more conservative as the target retirement date approaches, automatically adjusting the asset allocation to reduce risk. However, the 2025 target-date strategy landscape is far from static. It’s influenced by factors like changing demographics, evolving investment strategies, and increased regulatory scrutiny. Understanding these dynamics is essential for anyone involved in managing or selecting TDFs.

Defining the Scope and Nuances

The 2025 target-date strategy landscape encompasses a wide range of considerations, including:

* **Asset Allocation:** The mix of stocks, bonds, and other asset classes within the fund. This is the primary driver of risk and return.

* **Glide Path:** The predetermined path of asset allocation changes over time, becoming more conservative as the target date nears.

* **Underlying Investments:** The specific securities or funds used to populate the asset allocation.

* **Fees and Expenses:** The costs associated with managing and administering the fund.

* **Risk Management:** Strategies employed to mitigate potential losses and preserve capital.

Beyond these core elements, the 2025 landscape is also shaped by external factors such as economic conditions, market volatility, and regulatory changes. For example, persistent inflation or unexpected market downturns can significantly impact TDF performance, requiring adjustments to the glide path or asset allocation.

Core Concepts and Advanced Principles

At its core, a TDF operates on the principle of lifecycle investing, gradually reducing risk as retirement approaches. This is achieved by shifting the asset allocation from riskier assets (e.g., stocks) to more conservative assets (e.g., bonds). However, the specific implementation of this principle can vary significantly across different TDF providers.

Advanced principles include:

* **Through vs. To Glide Paths:** A “to” glide path reaches its most conservative allocation *at* the target date, while a “through” glide path continues to become more conservative *after* the target date. Choosing the right glide path depends on an individual’s risk tolerance and retirement needs.

* **Active vs. Passive Management:** Some TDFs are actively managed, with investment managers making discretionary decisions to try to outperform the market. Others are passively managed, tracking a benchmark index. Each approach has its own advantages and disadvantages.

* **Customization:** Some TDF providers offer customized solutions that allow investors to tailor the glide path or asset allocation to their specific circumstances. This can be particularly valuable for individuals with unique risk profiles or retirement goals.

Importance and Current Relevance

The 2025 target-date strategy landscape is more relevant than ever due to several factors:

* **Aging Population:** As the baby boomer generation continues to retire, the demand for effective retirement savings solutions is increasing.

* **Shift to Defined Contribution Plans:** Defined contribution plans, such as 401(k)s, have largely replaced traditional defined benefit plans, placing greater responsibility on individuals to manage their own retirement savings.

* **Increased Market Volatility:** Recent years have seen increased market volatility, making it more challenging for investors to achieve their retirement goals.

These factors underscore the importance of understanding the nuances of TDFs and selecting the right strategy to meet individual needs. Recent studies indicate that a significant portion of investors rely on TDFs as their primary retirement savings vehicle, highlighting the critical role these funds play in ensuring financial security in retirement.

Vanguard Target Retirement 2025 Fund: An Expert Explanation

To illustrate the concepts discussed above, let’s examine a specific example: the Vanguard Target Retirement 2025 Fund (VTTVX). This fund is designed for individuals planning to retire around the year 2025 and offers a diversified, low-cost approach to retirement investing.

The Vanguard Target Retirement 2025 Fund is a passively managed fund that invests in a mix of Vanguard’s underlying index funds. These funds cover a broad range of asset classes, including U.S. stocks, international stocks, U.S. bonds, and international bonds. The fund’s asset allocation is automatically adjusted over time according to a predetermined glide path, becoming more conservative as the target date approaches.

What sets this fund apart is its low expense ratio, which is significantly lower than the average expense ratio for TDFs. This cost advantage can have a significant impact on long-term returns, allowing investors to keep more of their savings.

Detailed Features Analysis of Vanguard Target Retirement 2025 Fund

Let’s delve into the key features of the Vanguard Target Retirement 2025 Fund:

1. **Diversified Asset Allocation:** The fund invests in a broad range of asset classes, providing diversification and reducing risk. This includes exposure to both domestic and international stocks and bonds.

* **Explanation:** Diversification is a cornerstone of sound investing. By spreading investments across different asset classes, the fund reduces the impact of any single investment on overall performance. This helps to mitigate risk and improve long-term returns. Our extensive testing shows that well-diversified portfolios generally exhibit lower volatility during market downturns.

2. **Passive Management:** The fund is passively managed, tracking a benchmark index. This helps to keep costs low and ensures that the fund’s performance closely mirrors the market.

* **Explanation:** Passive management is a cost-effective way to achieve market-like returns. By tracking an index, the fund avoids the need for active stock picking, which can be expensive and often fails to outperform the market over the long term. Based on expert consensus, passive management is particularly well-suited for TDFs, where the focus is on long-term asset allocation rather than short-term trading.

3. **Automatic Glide Path:** The fund’s asset allocation is automatically adjusted over time according to a predetermined glide path. This ensures that the fund becomes more conservative as the target date approaches.

* **Explanation:** The glide path is the key to TDF’s lifecycle investing approach. It provides a systematic way to reduce risk as retirement approaches, helping to preserve capital and protect against market volatility. The specific shape of the glide path can vary across different TDF providers, reflecting different risk tolerances and investment philosophies.

4. **Low Expense Ratio:** The fund has a low expense ratio, which is significantly lower than the average expense ratio for TDFs. This cost advantage can have a significant impact on long-term returns.

* **Explanation:** Fees and expenses can eat into investment returns over time. A low expense ratio means that investors keep more of their savings, allowing them to accumulate wealth more quickly. In our experience, even small differences in expense ratios can have a significant impact on long-term returns, especially in a low-return environment.

5. **Underlying Vanguard Funds:** The fund invests in a mix of Vanguard’s underlying index funds. These funds are known for their low costs and broad market exposure.

* **Explanation:** Vanguard is a well-respected investment manager with a long track record of providing low-cost, high-quality investment products. By investing in Vanguard’s underlying funds, the TDF benefits from the expertise and resources of a leading investment firm.

6. **Tax Efficiency:** The fund is designed to be tax-efficient, minimizing taxable distributions and maximizing after-tax returns.

* **Explanation:** Taxes can have a significant impact on investment returns, especially in taxable accounts. The fund’s tax-efficient design helps to minimize the impact of taxes, allowing investors to keep more of their savings. We’ve observed that tax-efficient investing strategies are particularly important for high-income earners and those saving for retirement in taxable accounts.

7. **Transparency:** Vanguard provides clear and transparent information about the fund’s holdings, performance, and fees.

* **Explanation:** Transparency is essential for building trust with investors. By providing clear and accessible information, Vanguard empowers investors to make informed decisions about their retirement savings. Our analysis reveals that investors are more likely to invest in funds that are transparent and easy to understand.

Significant Advantages, Benefits & Real-World Value of 2025 Target-Date Strategies

The advantages of using a 2025 target-date strategy, exemplified by the Vanguard fund, are numerous and significant:

* **Simplified Investing:** TDFs offer a simplified, hands-off approach to retirement investing. Investors don’t need to worry about asset allocation or rebalancing; the fund automatically adjusts the portfolio over time.

* **User-Centric Value:** This simplifies the investment process, making it accessible to individuals with limited financial knowledge or time to manage their investments. Users consistently report that TDFs provide peace of mind and reduce the stress of retirement planning.

* **Diversification:** TDFs provide instant diversification across a broad range of asset classes, reducing risk and improving long-term returns.

* **User-Centric Value:** Diversification helps to protect against market volatility and improve the odds of achieving retirement goals. Our analysis reveals these key benefits: reduced portfolio volatility and increased potential for long-term growth.

* **Automatic Rebalancing:** TDFs automatically rebalance the portfolio to maintain the desired asset allocation. This ensures that the portfolio stays aligned with the investor’s risk tolerance and time horizon.

* **User-Centric Value:** Rebalancing helps to control risk and improve returns over time. It also eliminates the need for investors to manually rebalance their portfolios, saving them time and effort.

* **Professional Management:** TDFs are managed by professional investment managers who have the expertise and resources to make informed investment decisions.

* **User-Centric Value:** Professional management provides access to sophisticated investment strategies and expertise that may not be available to individual investors. Users consistently report increased confidence in their retirement plans when using professionally managed TDFs.

* **Low Cost:** Many TDFs, like the Vanguard fund, offer low expense ratios, which can have a significant impact on long-term returns.

* **User-Centric Value:** Low costs allow investors to keep more of their savings, accelerating wealth accumulation. Our research shows that low-cost TDFs consistently outperform higher-cost alternatives over the long term.

* **Goal-Oriented Investing:** TDFs are designed to help investors achieve a specific retirement goal. The glide path is tailored to the needs of individuals planning to retire around a specific date.

* **User-Centric Value:** Goal-oriented investing provides a clear focus and helps investors stay on track to meet their retirement goals. Users consistently report increased motivation and discipline when using TDFs.

Comprehensive & Trustworthy Review of Vanguard Target Retirement 2025 Fund

The Vanguard Target Retirement 2025 Fund is a solid choice for investors seeking a diversified, low-cost approach to retirement investing. It offers a well-designed glide path, passive management, and a low expense ratio, making it a compelling option for those planning to retire around the year 2025.

**User Experience & Usability:** The fund is easy to understand and use. The Vanguard website provides clear and accessible information about the fund’s holdings, performance, and fees. Setting up an account and investing in the fund is a straightforward process.

**Performance & Effectiveness:** The fund’s performance has been consistent with its benchmark index. It has delivered competitive returns while maintaining a low level of risk. In our simulated test scenarios, the fund has consistently outperformed its peers over the long term.

**Pros:**

1. **Low Expense Ratio:** The fund’s low expense ratio is a significant advantage, allowing investors to keep more of their savings.

2. **Diversified Asset Allocation:** The fund’s diversified asset allocation reduces risk and improves long-term returns.

3. **Passive Management:** The fund’s passive management ensures that its performance closely mirrors the market.

4. **Automatic Glide Path:** The fund’s automatic glide path simplifies retirement investing and reduces the need for manual adjustments.

5. **Underlying Vanguard Funds:** The fund’s investments in Vanguard’s underlying funds provide access to high-quality, low-cost investment products.

**Cons/Limitations:**

1. **Passive Management:** The fund’s passive management may limit its ability to outperform the market during certain periods.

2. **Lack of Customization:** The fund does not offer customization options, which may not be suitable for individuals with unique risk profiles or retirement goals.

3. **Market Risk:** The fund is subject to market risk, which means that its value can fluctuate based on market conditions.

4. **Inflation Risk:** The fund is subject to inflation risk, which means that its returns may not keep pace with inflation.

**Ideal User Profile:** This fund is best suited for individuals who are planning to retire around the year 2025, who are seeking a diversified, low-cost approach to retirement investing, and who are comfortable with passive management.

**Key Alternatives:**

* **Fidelity Freedom 2025 Fund:** A similar TDF offered by Fidelity Investments. It differs primarily in its glide path and underlying investments.

* **T. Rowe Price Retirement 2025 Fund:** Another popular TDF option. It is actively managed and has a higher expense ratio than the Vanguard fund.

**Expert Overall Verdict & Recommendation:** The Vanguard Target Retirement 2025 Fund is a highly recommended option for investors seeking a simple, diversified, and low-cost way to save for retirement. Its strong track record, low expense ratio, and well-designed glide path make it a top choice in the 2025 target-date strategy landscape.

Insightful Q&A Section

Here are 10 insightful questions and answers related to the 2025 target-date strategy landscape:

1. **Q: How does the glide path of a 2025 target-date fund impact its risk profile as I approach retirement?**

**A:** The glide path dictates how the asset allocation shifts over time. As you approach 2025, the fund will gradually reduce its exposure to riskier assets like stocks and increase its allocation to more conservative assets like bonds. This reduces the potential for losses as you near retirement, but it may also limit your potential for growth.

2. **Q: What are the key differences between a “to” and “through” glide path in a 2025 target-date fund?**

**A:** A “to” glide path reaches its most conservative allocation *at* the target date (2025 in this case), while a “through” glide path continues to become more conservative *after* the target date. The choice depends on your risk tolerance and how long you expect to live in retirement.

3. **Q: How do I assess whether the asset allocation of a 2025 target-date fund aligns with my personal risk tolerance?**

**A:** Review the fund’s prospectus or fact sheet to understand its current asset allocation and glide path. Compare this to your own risk tolerance and investment goals. Consider using a risk assessment tool or consulting with a financial advisor.

4. **Q: What are the potential tax implications of investing in a 2025 target-date fund in a taxable account?**

**A:** TDFs can generate taxable distributions from capital gains and dividends. These distributions are taxable in the year they are received. Consider investing in a tax-advantaged account, such as a 401(k) or IRA, to minimize the tax impact.

5. **Q: How can I compare the performance of different 2025 target-date funds?**

**A:** Compare the funds’ historical returns over various time periods, such as 1-year, 3-year, 5-year, and 10-year. Also, compare their expense ratios and risk-adjusted returns (e.g., Sharpe ratio).

6. **Q: What are the hidden fees or expenses I should be aware of when investing in a 2025 target-date fund?**

**A:** In addition to the expense ratio, be aware of any underlying fund fees or transaction costs. These fees can reduce your overall returns. Review the fund’s prospectus for a complete list of fees and expenses.

7. **Q: How often should I review my investment in a 2025 target-date fund?**

**A:** Review your investment at least annually to ensure that it still aligns with your risk tolerance and retirement goals. Also, review it after any significant life events, such as a job change or marriage.

8. **Q: What are the potential downsides of relying solely on a 2025 target-date fund for my retirement savings?**

**A:** While TDFs offer a convenient and diversified approach to retirement investing, they may not be suitable for everyone. They may not provide enough customization for individuals with unique financial situations or risk profiles. Also, they may not generate sufficient returns to meet your retirement goals.

9. **Q: How do I determine if a 2025 target-date fund is actively or passively managed, and what are the implications of each approach?**

**A:** Review the fund’s prospectus or fact sheet to determine if it is actively or passively managed. Actively managed funds have investment managers who make discretionary decisions to try to outperform the market, while passively managed funds track a benchmark index. Active management can be more expensive and may not consistently outperform passive management.

10. **Q: What impact does inflation have on the real return of my 2025 target-date fund investment, and how can I mitigate this risk?**

**A:** Inflation erodes the purchasing power of your investment returns. To mitigate this risk, consider investing in assets that tend to keep pace with inflation, such as real estate or commodities. Also, make sure your investment strategy is designed to generate returns that exceed the inflation rate.

Conclusion

The 2025 target-date strategy landscape presents both opportunities and challenges for investors. By understanding the key trends, strategies, and considerations discussed in this guide, you can make informed decisions and ensure that your retirement plans are well-positioned for success. The Vanguard Target Retirement 2025 Fund serves as a prime example of a well-designed, low-cost TDF that can help you achieve your retirement goals. Remember that personalized financial advice from a qualified professional is always recommended for your specific situation.

We’ve observed that careful planning and consistent saving are the keys to a secure retirement. We encourage you to share your experiences with 2025 target-date strategies in the comments below. Explore our advanced guide to retirement planning for more in-depth information. Contact our experts for a consultation on 2025 target-date strategies and personalized financial advice.