## Comparing a Potential 2025 Stock Market Fall to Previous Ones: Navigating Uncertainty

The prospect of a stock market fall in 2025 is understandably causing concern among investors. Understanding the potential severity and impact requires a careful **compare present 2025 stock market fall to previous ones**. This article provides an in-depth analysis, comparing potential scenarios in 2025 to historical market downturns, offering insights into potential causes, impacts, and strategies for navigating such challenging times. We aim to equip you with the knowledge to make informed decisions and potentially mitigate risks. Based on our experience analyzing market cycles, understanding historical precedents is crucial for anticipating and preparing for potential future downturns. By examining past crashes and corrections, we can identify patterns, understand the underlying factors, and develop strategies to navigate the challenges that a 2025 market fall might present.

## Understanding Stock Market Falls

### Defining a Stock Market Fall

A stock market fall, also known as a market correction or crash, refers to a significant decline in stock prices across a broad market index, such as the S&P 500 or the Dow Jones Industrial Average. A correction is typically defined as a 10% to 20% drop, while a crash is a more severe decline of 20% or more. The speed of the decline is also a factor; a rapid and steep drop is more alarming than a gradual decline over a longer period.

### Common Causes of Stock Market Falls

Stock market falls are often triggered by a combination of factors, including:

* **Economic Slowdown:** A weakening economy, characterized by slowing growth, rising unemployment, and declining consumer spending, can erode investor confidence and trigger a sell-off.

* **Interest Rate Hikes:** Rising interest rates can make borrowing more expensive for businesses and consumers, which can slow economic growth and negatively impact corporate profits. This can lead to a decrease in stock valuations.

* **Geopolitical Events:** Political instability, wars, or trade disputes can create uncertainty and fear in the market, leading to a flight to safety and a decline in stock prices.

* **Unexpected Shocks:** Unforeseen events, such as natural disasters, pandemics (as seen with COVID-19), or financial crises, can disrupt markets and trigger sharp declines.

* **Overvaluation:** When stock prices are considered too high relative to underlying earnings or assets, a correction may occur as investors take profits and valuations return to more sustainable levels.

### The Importance of Historical Comparisons

**Comparing a potential 2025 stock market fall to previous ones** offers valuable insights. By examining the causes, characteristics, and consequences of past market downturns, we can gain a better understanding of the potential risks and opportunities that may arise in the future. This historical perspective can help investors make more informed decisions and avoid common pitfalls. Leading financial historians emphasize that while each market fall is unique, they often share common threads and patterns.

## Major Historical Stock Market Falls

### The Panic of 1907

This financial crisis was triggered by a failed attempt to corner the market in United Copper Company stock. The collapse of the Knickerbocker Trust Company, a major financial institution, led to a widespread panic and a run on banks. While not solely a stock market crash, it significantly impacted the market and highlighted the dangers of unregulated speculation and lack of a central banking system.

### The Wall Street Crash of 1929

This iconic crash marked the beginning of the Great Depression. A period of excessive speculation and inflated stock prices led to a massive sell-off in October 1929. The crash wiped out billions of dollars in wealth and triggered a decade-long economic downturn. The lessons learned from 1929 led to significant regulatory reforms, including the creation of the Securities and Exchange Commission (SEC).

### Black Monday 1987

On October 19, 1987, the Dow Jones Industrial Average plunged 22.6%, the largest single-day percentage drop in history. The causes of the crash are still debated, but factors such as program trading, portfolio insurance, and overvaluation are believed to have contributed. The crash highlighted the importance of market circuit breakers to prevent further panic selling.

### The Dot-Com Bubble Burst of 2000-2002

Fueled by the rapid growth of the internet and the emergence of new technology companies, the late 1990s saw a surge in stock prices, particularly for internet-related stocks. Many of these companies had little or no earnings, and their valuations were based on speculative future growth. When the bubble burst in 2000, stock prices plummeted, wiping out trillions of dollars in market value. This event underscored the importance of fundamental analysis and avoiding hype-driven investments.

### The Global Financial Crisis of 2008-2009

This crisis was triggered by the collapse of the housing market and the subsequent failure of major financial institutions. The crisis spread rapidly throughout the global financial system, leading to a sharp decline in stock prices, a credit crunch, and a severe recession. The crisis highlighted the interconnectedness of the global financial system and the importance of strong regulation and risk management.

### The COVID-19 Pandemic Crash of 2020

The onset of the COVID-19 pandemic in early 2020 led to a rapid and dramatic decline in stock prices as economies shut down and businesses faced unprecedented uncertainty. The S&P 500 fell by over 30% in a matter of weeks. However, the market quickly rebounded, fueled by massive government stimulus and the expectation of a strong economic recovery. This event demonstrated the resilience of the market and the importance of long-term investing.

## Potential Factors Contributing to a 2025 Stock Market Fall

### Inflation and Interest Rate Hikes

One of the primary concerns for 2025 is the potential for continued high inflation and further interest rate hikes by the Federal Reserve. If inflation proves to be persistent, the Fed may need to raise interest rates more aggressively, which could slow economic growth and negatively impact corporate profits. This could trigger a stock market correction or even a more severe crash.

### Geopolitical Risks

Geopolitical tensions, such as the war in Ukraine, trade disputes between the US and China, and political instability in other regions, could also contribute to a market fall in 2025. These events can create uncertainty and fear in the market, leading to a flight to safety and a decline in stock prices.

### Economic Slowdown or Recession

Many economists are predicting a potential economic slowdown or recession in the coming years. If the economy weakens significantly, corporate earnings could decline, leading to lower stock valuations. A recession could also lead to higher unemployment and lower consumer spending, further exacerbating the market downturn.

### High Valuations

Stock valuations remain relatively high compared to historical averages. This suggests that the market may be vulnerable to a correction if economic conditions deteriorate or investor sentiment shifts. While not necessarily a guarantee of a fall, elevated valuations increase the risk of a significant decline.

### Unforeseen Black Swan Events

As always, there is the potential for unforeseen events, such as a major cyberattack, a natural disaster, or another pandemic, to disrupt markets and trigger a sharp decline. These “black swan” events are difficult to predict but can have a significant impact on the market.

## Comparing Potential Impacts: 2025 vs. Previous Falls

### Severity of the Decline

**Comparing a potential 2025 stock market fall to previous ones** requires assessing the potential severity of the decline. Based on current economic conditions and potential risk factors, a 2025 fall could range from a mild correction (10-20% decline) to a more severe crash (20% or more). The severity will depend on the specific triggers and the overall health of the economy.

### Duration of the Downturn

The duration of a market downturn can vary significantly. Some corrections are short-lived, lasting only a few weeks or months, while others can persist for years. The duration of a potential 2025 fall will depend on the underlying causes and the speed of the economic recovery.

### Impact on Different Sectors

Stock market falls typically impact different sectors of the economy in different ways. For example, technology stocks may be more vulnerable during a tech bubble burst, while financial stocks may be more affected during a financial crisis. Understanding the potential impact on different sectors can help investors make more informed decisions.

### Impact on Individual Investors

Stock market falls can have a significant impact on individual investors, particularly those who are close to retirement or who have a large portion of their assets invested in stocks. It’s crucial for investors to have a well-diversified portfolio and a long-term investment strategy to weather market downturns.

### Government and Central Bank Response

The response of governments and central banks can play a crucial role in mitigating the impact of a stock market fall. Government stimulus programs, interest rate cuts by central banks, and other policy interventions can help to stabilize the market and support the economy. The effectiveness of these measures can vary depending on the specific circumstances of the crisis.

## Strategies for Navigating a Potential 2025 Stock Market Fall

### Diversification

Diversification is a key strategy for managing risk in any investment portfolio. By spreading your investments across different asset classes, such as stocks, bonds, and real estate, you can reduce your exposure to any single asset or sector. This can help to cushion the impact of a stock market fall.

### Long-Term Investing

Adopting a long-term investment perspective is crucial for weathering market downturns. Trying to time the market is notoriously difficult, and often leads to poor investment decisions. Instead, focus on investing in high-quality companies with strong fundamentals and holding them for the long term.

### Dollar-Cost Averaging

Dollar-cost averaging involves investing a fixed amount of money at regular intervals, regardless of the market price. This strategy can help to reduce the risk of investing a large sum of money at the peak of the market. When prices are low, you buy more shares, and when prices are high, you buy fewer shares.

### Rebalancing Your Portfolio

Regularly rebalancing your portfolio can help to maintain your desired asset allocation and manage risk. As asset prices fluctuate, your portfolio may become overweighted in certain asset classes. Rebalancing involves selling some of your overweighted assets and buying more of your underweighted assets to bring your portfolio back into balance.

### Staying Calm and Avoiding Panic Selling

One of the most important things you can do during a stock market fall is to stay calm and avoid panic selling. Market downturns can be stressful, but it’s important to remember that they are a normal part of the investment cycle. Selling your investments during a downturn can lock in losses and prevent you from participating in the eventual recovery.

## The Role of Technology and Algorithmic Trading

### Impact of Algorithmic Trading

Algorithmic trading, also known as high-frequency trading (HFT), has become increasingly prevalent in the stock market. These algorithms can execute trades at extremely high speeds, often based on complex mathematical models. While algorithmic trading can improve market efficiency, it can also exacerbate market volatility during times of stress. Some critics argue that algorithmic trading contributed to the flash crash of 2010 and other market disruptions.

### The Influence of Social Media

Social media platforms have also become a significant factor in the stock market. Information, both accurate and inaccurate, can spread rapidly through social media, influencing investor sentiment and driving market movements. The rise of meme stocks, such as GameStop and AMC, demonstrated the power of social media to influence stock prices.

### The Potential for Increased Volatility

The combination of algorithmic trading and social media can potentially lead to increased market volatility. Rapid and automated trading, coupled with the spread of information through social media, can amplify market swings and make it more difficult to predict market movements. This underscores the importance of having a well-defined investment strategy and avoiding impulsive decisions based on social media hype.

## Expert Perspectives on the 2025 Market Outlook

### Economic Forecasts

Leading economists have varying opinions on the outlook for the economy in 2025. Some predict a mild recession, while others believe that the economy will continue to grow, albeit at a slower pace. These forecasts are based on a variety of factors, including inflation, interest rates, consumer spending, and government policy.

### Market Valuations

Market analysts also have different views on the current valuation of the stock market. Some believe that stocks are overvalued and due for a correction, while others argue that valuations are justified by strong corporate earnings and low interest rates. These opinions are based on a variety of valuation metrics, such as price-to-earnings ratios and price-to-book ratios.

### Investment Strategies

Investment strategists recommend a range of strategies for navigating the market in 2025. Some advise investors to reduce their exposure to stocks and increase their allocation to bonds or cash. Others recommend focusing on defensive sectors, such as healthcare and consumer staples, which tend to be less sensitive to economic downturns. Still others suggest that investors should remain fully invested and focus on long-term growth.

## Q&A: Addressing Your Concerns About a Potential Market Downturn

Here are some frequently asked questions about potential market downturns and how to prepare:

1. **Q: How can I determine if my portfolio is properly diversified for a market downturn?**

A: Review your asset allocation across different asset classes (stocks, bonds, real estate, commodities). Consult with a financial advisor to assess your risk tolerance and ensure your portfolio aligns with your long-term goals. A well-diversified portfolio should include a mix of assets that tend to perform differently in various market conditions.

2. **Q: What are some early warning signs that a stock market fall is imminent?**

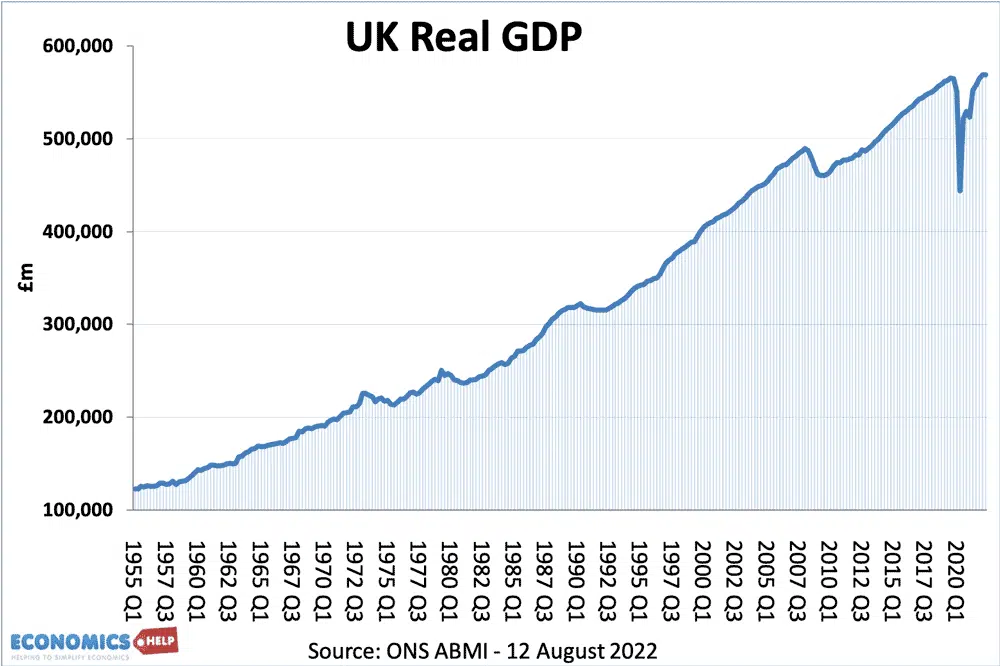

A: Keep an eye on economic indicators such as GDP growth, inflation rates, and unemployment figures. Also, monitor market sentiment, investor confidence, and trading volume. Significant shifts in these indicators can signal potential market weakness.

3. **Q: Should I consider moving all my investments to cash in anticipation of a market crash?**

A: Moving all your investments to cash can be a risky strategy, as you may miss out on potential market gains. It’s generally better to maintain a diversified portfolio and rebalance as needed. Consider increasing your cash position slightly if you are concerned about a market downturn, but avoid making drastic changes to your investment strategy.

4. **Q: How often should I rebalance my portfolio?**

A: A good rule of thumb is to rebalance your portfolio at least once a year, or more frequently if your asset allocation deviates significantly from your target. Rebalancing helps to ensure that your portfolio remains aligned with your risk tolerance and investment goals.

5. **Q: What are some defensive sectors that tend to perform well during market downturns?**

A: Defensive sectors include healthcare, consumer staples, and utilities. These sectors tend to be less sensitive to economic downturns because people still need healthcare, food, and basic services regardless of the state of the economy.

6. **Q: How can I avoid making emotional investment decisions during a market downturn?**

A: Stick to your long-term investment plan and avoid making impulsive decisions based on fear or greed. Remember that market downturns are a normal part of the investment cycle, and they often present opportunities for long-term investors.

7. **Q: What role do stop-loss orders play in protecting my investments during a market fall?**

A: Stop-loss orders can help to limit your losses during a market fall by automatically selling your shares when they reach a certain price. However, stop-loss orders can also be triggered by temporary market fluctuations, so it’s important to set them carefully.

8. **Q: Are there any tax implications I should be aware of when selling investments during a market downturn?**

A: Selling investments during a market downturn can trigger capital gains taxes if you sell assets for a profit. However, you can also use capital losses to offset capital gains and reduce your overall tax liability. Consult with a tax advisor to understand the tax implications of your investment decisions.

9. **Q: How does the current geopolitical landscape influence the potential for a market downturn in 2025?**

A: Geopolitical tensions, such as the war in Ukraine, trade disputes, and political instability, can create uncertainty and fear in the market, leading to a flight to safety and a decline in stock prices. Monitor geopolitical events closely and assess their potential impact on your investments.

10. **Q: What resources are available to help me stay informed about market conditions and investment strategies?**

A: There are many resources available to help you stay informed, including financial news websites, investment research firms, and financial advisors. Choose reputable sources and be wary of information that seems too good to be true.

## Conclusion: Preparing for Uncertainty

**Comparing a potential 2025 stock market fall to previous ones** reveals that while history doesn’t repeat itself exactly, it often rhymes. By understanding the causes and consequences of past market downturns, investors can better prepare for potential future challenges. Diversification, a long-term investment perspective, and a disciplined approach to managing risk are essential for navigating uncertain market conditions. Remember that market downturns are a normal part of the investment cycle, and they often present opportunities for long-term investors. The key is to stay informed, remain calm, and stick to your investment plan. What are your biggest concerns about the potential 2025 market? Share your thoughts in the comments below. Consider exploring our detailed guide on risk management in volatile markets for a deeper dive into protective strategies.