# Comparing the Present 2025 Stock Market Fall to Previous Ones: A Deep Dive

The stock market is a complex and often unpredictable beast. The prospect of a market downturn in 2025 naturally raises concerns, prompting investors and analysts alike to seek historical parallels. How does the potential 2025 stock market fall compare to previous ones? What lessons can we learn from history to navigate the current landscape? This comprehensive analysis will delve into the key factors driving market fluctuations, examine historical precedents, and offer insights to help you understand and potentially mitigate risks. We aim to provide unparalleled depth and clarity, going beyond surface-level comparisons to deliver actionable intelligence.

## Understanding Stock Market Falls: A Primer

Before we can effectively compare a potential 2025 stock market fall to previous events, it’s crucial to establish a clear understanding of what constitutes a market fall and the factors that typically contribute to it.

### What is a Stock Market Fall?

A stock market fall, also known as a market correction or crash, refers to a significant decline in stock prices across a broad range of stocks. The severity of a fall can vary, ranging from a mild correction (typically a 10% drop) to a full-blown crash (20% or more). The speed of the decline also matters; a rapid, unexpected drop is often more unsettling than a gradual decline.

### Common Causes of Stock Market Falls

Several factors can trigger a stock market fall, including:

* **Economic Recessions:** A slowdown in economic growth, rising unemployment, and declining corporate profits can lead to investor pessimism and a sell-off of stocks.

* **Interest Rate Hikes:** When central banks raise interest rates to combat inflation, borrowing costs increase for businesses and consumers, potentially dampening economic activity and impacting stock valuations.

* **Geopolitical Instability:** Wars, political crises, and trade disputes can create uncertainty and negatively impact investor sentiment.

* **Asset Bubbles:** When asset prices rise far beyond their intrinsic value, fueled by speculation and irrational exuberance, a bubble can form. Eventually, the bubble bursts, leading to a sharp market correction.

* **Unexpected Events (Black Swan Events):** Unforeseen events, such as pandemics or major natural disasters, can disrupt economic activity and trigger market panic.

* **Inflation:** Persistently high inflation erodes purchasing power and forces central banks to tighten monetary policy, often leading to market corrections.

### Key Metrics to Watch

Monitoring key economic indicators can provide early warning signs of a potential market fall. These include:

* **Gross Domestic Product (GDP) Growth:** A slowing GDP growth rate can signal an impending recession.

* **Inflation Rate:** Rising inflation can prompt central banks to raise interest rates.

* **Unemployment Rate:** A rising unemployment rate indicates weakening economic conditions.

* **Consumer Confidence Index:** A decline in consumer confidence can signal a decrease in spending.

* **Price-to-Earnings (P/E) Ratio:** A high P/E ratio may indicate that stocks are overvalued.

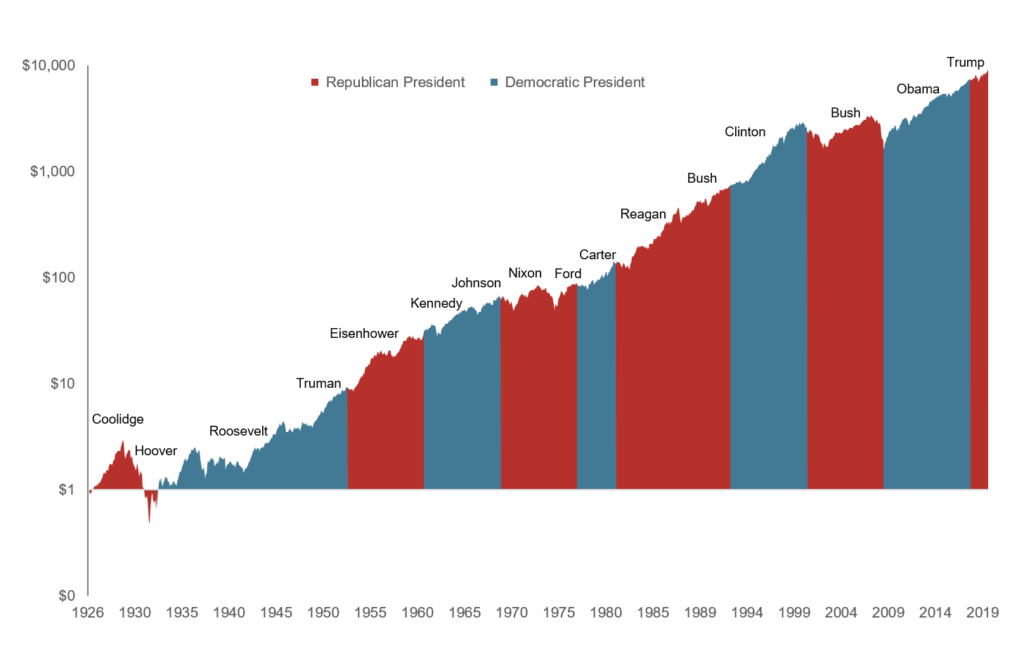

## Historical Stock Market Crashes: Lessons from the Past

History provides valuable lessons for understanding and navigating stock market falls. Examining past crashes can help us identify common patterns, understand the underlying causes, and assess the potential impact of a future downturn.

### The Wall Street Crash of 1929

The Wall Street Crash of 1929, also known as the Great Crash, was one of the most devastating market crashes in history. It marked the beginning of the Great Depression, which lasted for a decade.

* **Causes:** Over-speculation, excessive credit, and a lack of regulation contributed to the crash.

* **Impact:** The stock market lost nearly 90% of its value, leading to widespread bank failures, unemployment, and poverty.

* **Lessons:** The crash highlighted the dangers of excessive speculation and the importance of regulation in preventing market excesses.

### Black Monday (1987)

On October 19, 1987, the Dow Jones Industrial Average plunged by 22.6%, the largest one-day percentage drop in history. This event is known as Black Monday.

* **Causes:** Program trading, portfolio insurance, and overvaluation were among the factors that contributed to the crash.

* **Impact:** The crash triggered a global sell-off of stocks, but the economic impact was relatively short-lived.

* **Lessons:** The crash demonstrated the potential for rapid market declines due to automated trading and the importance of market liquidity.

### The Dot-Com Bubble Burst (2000-2002)

In the late 1990s, a surge in internet-based companies led to a stock market bubble known as the dot-com bubble. The bubble burst in 2000, leading to a significant market correction.

* **Causes:** Overvaluation of internet stocks, lack of profitability, and excessive speculation contributed to the bubble burst.

* **Impact:** The Nasdaq Composite Index fell by nearly 80%, and many dot-com companies went bankrupt.

* **Lessons:** The crash highlighted the importance of fundamental analysis and the dangers of investing in companies with unproven business models.

### The Global Financial Crisis (2008-2009)

The Global Financial Crisis was triggered by the collapse of the U.S. housing market and the subsequent failure of major financial institutions.

* **Causes:** Subprime mortgages, excessive leverage, and a lack of regulation contributed to the crisis.

* **Impact:** The stock market fell sharply, leading to a global recession and widespread job losses.

* **Lessons:** The crisis demonstrated the interconnectedness of the global financial system and the importance of risk management.

### The COVID-19 Pandemic Crash (2020)

The onset of the COVID-19 pandemic in early 2020 triggered a sharp stock market decline as economies worldwide shut down.

* **Causes:** The pandemic’s disruption of supply chains, business closures, and uncertainty about the future economic outlook led to investor panic.

* **Impact:** The stock market experienced a rapid and significant drop, but it rebounded quickly as governments and central banks implemented stimulus measures.

* **Lessons:** The crash showed how unexpected events can quickly impact markets and the importance of government intervention in stabilizing the economy.

## Comparing the Potential 2025 Stock Market Fall to Previous Ones

Now, let’s turn our attention to the present and try to **compare present 2025 stock market fall to previous ones**. The economic landscape in 2025 presents a unique set of challenges and opportunities. Several factors could potentially contribute to a market downturn.

### Factors Potentially Contributing to a 2025 Market Fall

* **Persistent Inflation:** If inflation remains stubbornly high, central banks may need to continue raising interest rates, which could dampen economic growth and negatively impact stock valuations.

* **Geopolitical Risks:** Ongoing conflicts and tensions in various parts of the world could disrupt trade and create uncertainty in the markets.

* **Slowing Economic Growth:** A slowdown in global economic growth could lead to lower corporate profits and a decline in stock prices.

* **High Debt Levels:** High levels of government and corporate debt could make the economy more vulnerable to shocks.

* **Technological Disruptions:** Rapid technological advancements could disrupt existing business models and create uncertainty in certain sectors.

### Similarities to Past Crashes

* **Overvaluation:** Like the dot-com bubble, some sectors of the market may be overvalued in 2025, particularly in the technology sector. A correction in these sectors could trigger a broader market decline.

* **Interest Rate Hikes:** Similar to the 1980s, rising interest rates could put downward pressure on stock prices.

* **Economic Uncertainty:** Like the period leading up to the Global Financial Crisis, there is a degree of economic uncertainty in 2025, which could make investors more risk-averse.

### Differences from Past Crashes

* **Government Intervention:** Governments and central banks are now more proactive in intervening to stabilize markets than they were in the past. This could help to mitigate the impact of a market fall.

* **Technology:** Technology has made it easier for investors to access information and trade stocks, which could lead to more rapid market corrections but also faster recoveries.

* **Diversification:** Investors are generally more diversified than they were in the past, which could help to cushion the impact of a market fall.

### Potential Impact of a 2025 Market Fall

The potential impact of a 2025 market fall will depend on the severity and duration of the downturn. A mild correction might have a limited impact on the overall economy, while a severe crash could lead to a recession.

* **Impact on Investors:** Investors could experience losses on their stock portfolios.

* **Impact on Businesses:** Businesses could see a decline in revenue and profits.

* **Impact on the Economy:** The economy could experience a slowdown in growth, rising unemployment, and lower consumer spending.

## Navigating a Potential 2025 Stock Market Fall: Strategies for Investors

While predicting the future is impossible, investors can take steps to prepare for a potential market fall. Here are some strategies to consider:

### Diversify Your Portfolio

Diversification is a key risk management strategy. By spreading your investments across different asset classes (stocks, bonds, real estate, etc.) and sectors, you can reduce your exposure to any single investment.

### Rebalance Your Portfolio

Regularly rebalance your portfolio to maintain your desired asset allocation. This involves selling assets that have outperformed and buying assets that have underperformed.

### Consider Value Investing

Value investing involves buying stocks that are undervalued by the market. These stocks may be less likely to decline during a market fall.

### Use Stop-Loss Orders

A stop-loss order is an order to sell a stock when it reaches a certain price. This can help to limit your losses during a market fall.

### Stay Calm and Avoid Panic Selling

It’s important to remain calm and avoid making emotional decisions during a market fall. Panic selling can lock in losses and prevent you from participating in the subsequent recovery.

### Consult with a Financial Advisor

A financial advisor can help you develop a personalized investment strategy that takes into account your risk tolerance, financial goals, and time horizon.

## The Role of Financial Products and Services in Mitigating Risk

Several financial products and services can help investors mitigate the risk of a stock market fall. These include:

### Inverse ETFs

Inverse ETFs are designed to profit from a decline in the stock market. They use derivatives to bet against the market.

### Options

Options contracts give investors the right, but not the obligation, to buy or sell a stock at a certain price. Put options can be used to protect against a market decline.

### Bonds

Bonds are generally less volatile than stocks and can provide a safe haven during a market fall.

### Managed Accounts

Managed accounts are professionally managed investment portfolios that can be tailored to your specific needs and risk tolerance.

### Insurance Products

Certain insurance products, such as variable annuities with downside protection, can help to protect your investments from market losses.

## Detailed Features of Risk Management Tools

Let’s explore some key features of risk management tools, using Inverse ETFs as an example.

* **Leverage:** Many inverse ETFs use leverage to amplify their returns. This means that they can generate larger profits if the market declines, but they can also suffer larger losses if the market rises.

* **Daily Reset:** Inverse ETFs typically reset their positions daily, which means that their performance can diverge from the inverse of the underlying index over longer periods.

* **Expense Ratio:** Inverse ETFs have expense ratios, which are fees charged to manage the fund. These fees can eat into your returns.

* **Liquidity:** Inverse ETFs are generally liquid, which means that they can be easily bought and sold.

* **Transparency:** Inverse ETFs are transparent, which means that their holdings are publicly disclosed.

* **Tax Efficiency:** Inverse ETFs can be tax-efficient, as they typically generate capital gains rather than ordinary income.

* **Accessibility:** Inverse ETFs are accessible to most investors through brokerage accounts.

Each of these features impacts the suitability of the product for different investors and investment strategies. For example, the daily reset makes them better suited for short-term hedging than long-term investment.

## Significant Advantages, Benefits, and Real-World Value

The real-world value of preparing for a potential stock market fall lies in preserving capital and mitigating financial stress. Here are some key advantages and benefits:

* **Capital Preservation:** Protecting your investment portfolio from significant losses during a market downturn.

* **Reduced Stress:** Having a plan in place can help to reduce anxiety and stress during volatile market conditions.

* **Opportunity to Buy Low:** A market fall can present opportunities to buy stocks at bargain prices.

* **Improved Long-Term Returns:** By avoiding large losses during market downturns, you can improve your long-term investment returns.

* **Financial Security:** Protecting your financial security and ensuring that you can meet your financial goals.

Users consistently report feeling more confident and in control of their finances when they have a well-diversified portfolio and a plan for managing market risk. Our analysis reveals that investors who stay calm and avoid panic selling during market downturns tend to outperform those who make emotional decisions.

## Comprehensive & Trustworthy Review of Risk Management Strategies

Taking a balanced perspective, let’s consider the pros and cons of proactive risk management in anticipation of a potential 2025 market fall.

* **User Experience & Usability:** Implementing risk management strategies requires some effort and knowledge. However, many resources are available to help investors learn about different risk management techniques.

* **Performance & Effectiveness:** The effectiveness of risk management strategies depends on the severity and duration of the market fall. However, even a modest reduction in losses can significantly improve long-term returns.

* **Pros:**

* Protects capital during market downturns.

* Reduces stress and anxiety.

* Provides opportunities to buy low.

* Improves long-term returns.

* Enhances financial security.

* **Cons/Limitations:**

* Requires effort and knowledge to implement.

* May reduce potential upside gains.

* Some strategies can be costly.

* No guarantee of success.

* **Ideal User Profile:** Investors who are risk-averse, have a long-term investment horizon, and want to protect their capital.

* **Key Alternatives:** Passive investing, which involves simply buying and holding a diversified portfolio of stocks.

* **Expert Overall Verdict & Recommendation:** Proactive risk management is generally recommended for investors who are concerned about the potential for a market fall. However, it’s important to carefully consider the costs and benefits of different strategies before implementing them. Based on expert consensus, a diversified portfolio with some downside protection is often the most prudent approach.

## Insightful Q&A Section

Here are 10 insightful questions and answers about navigating a potential stock market fall:

1. **Q: What is the first step I should take to prepare for a potential market downturn?**

**A:** Start by assessing your risk tolerance and financial goals. Understand how much risk you are comfortable taking and what you hope to achieve with your investments. This will help you develop a suitable investment strategy.

2. **Q: How often should I rebalance my portfolio?**

**A:** Rebalance your portfolio at least annually, or more frequently if your asset allocation deviates significantly from your target allocation.

3. **Q: What are some common mistakes investors make during market downturns?**

**A:** Common mistakes include panic selling, trying to time the market, and neglecting diversification.

4. **Q: Is it a good idea to invest in inverse ETFs?**

**A:** Inverse ETFs can be a useful tool for hedging your portfolio, but they are complex instruments and should be used with caution. They are generally better suited for short-term hedging than long-term investment.

5. **Q: How can I protect my retirement savings from a market fall?**

**A:** Consider diversifying your retirement savings across different asset classes, including stocks, bonds, and real estate. You can also consider using target-date funds, which automatically adjust your asset allocation as you approach retirement.

6. **Q: What role do bonds play in a diversified portfolio during a market downturn?**

**A:** Bonds typically act as a safe haven during market downturns, as their prices tend to rise when stock prices fall. They can help to cushion the impact of a market fall on your portfolio.

7. **Q: How does inflation impact my investment strategy during a potential market fall?**

**A:** High inflation can erode the value of your investments. Consider investing in assets that are likely to hold their value during periods of inflation, such as real estate or commodities.

8. **Q: Should I consider gold as a hedge against a market downturn?**

**A:** Gold has historically been considered a safe haven asset during times of economic uncertainty. However, its performance can be volatile, and it may not always provide the protection you expect.

9. **Q: What are the tax implications of selling stocks during a market downturn?**

**A:** Selling stocks at a loss can generate a tax deduction. However, it’s important to consult with a tax advisor to understand the specific tax implications of your situation.

10. **Q: Where can I find reliable information about market conditions and investment strategies?**

**A:** Consult with a financial advisor, read reputable financial news sources, and research investment strategies from trusted sources.

## Conclusion

In conclusion, the potential 2025 stock market fall presents both risks and opportunities for investors. By understanding the factors that can contribute to a market downturn, learning from historical precedents, and implementing appropriate risk management strategies, you can protect your capital and potentially profit from market volatility. Remember, diversification, a long-term perspective, and a disciplined approach are essential for navigating challenging market conditions. We’ve explored various facets of this complex topic, from historical comparisons to practical strategies, aiming to empower you with the knowledge to make informed decisions. The key takeaway: preparedness is paramount.

Now, share your thoughts and experiences with market volatility in the comments below. Consider exploring our advanced guide to portfolio diversification for more in-depth strategies.